Foreign companies seeking to expand their global presence find the United States to be an attractive destination due to its vast market potential, access to specialized talent, and status as a major economic player. However, hiring employees in the US while operating from another country comes with its challenges. Not only are US employment laws different from those in other countries, but each state also has a unique set of employment laws and tax codes. To ensure compliance, global companies need to navigate both federal and state employment requirements.

This guide provides foreign companies with insights into the process of hiring employees in the US while highlighting the important federal and state employment laws to be aware of.

Can your foreign company hire in the US? Absolutely!

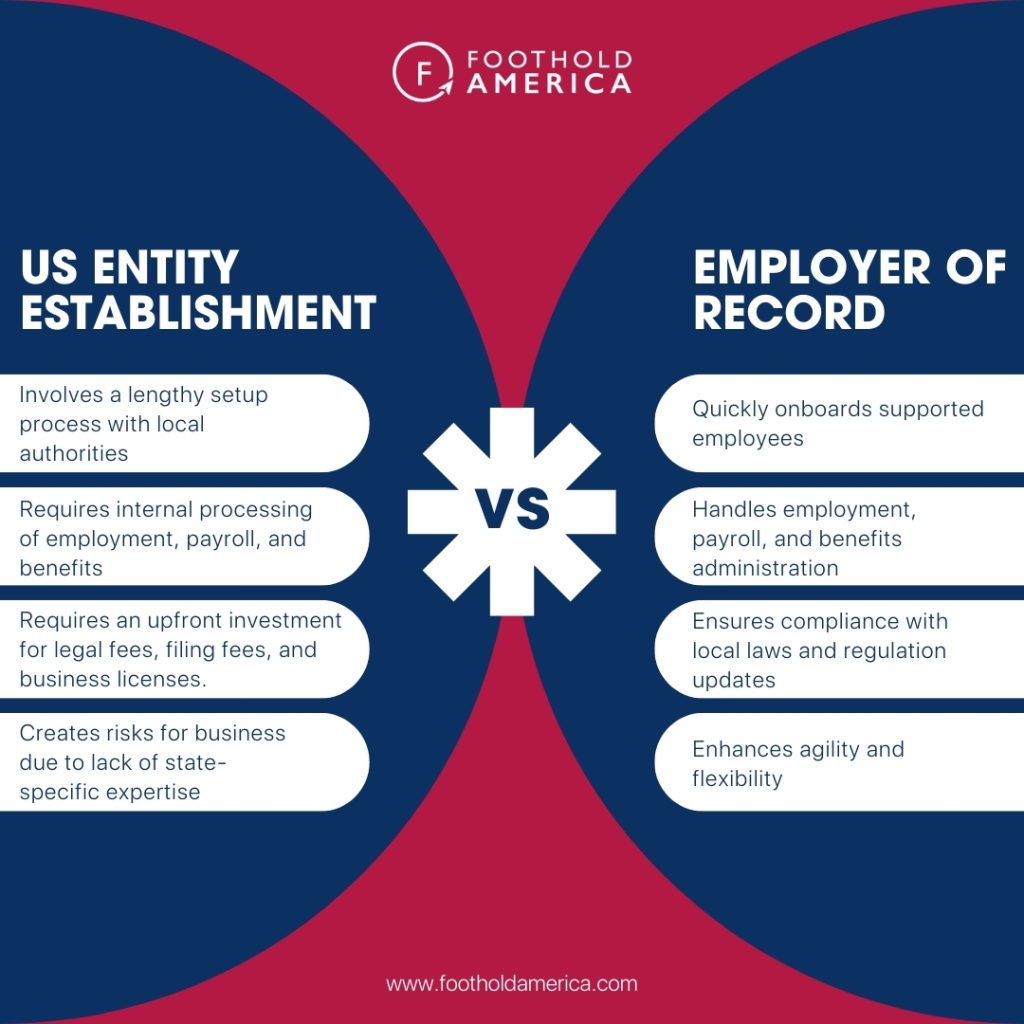

Foreign companies have two primary options for hiring employees in the US while remaining compliant with local laws. One option is to establish a legal entity and hire employees directly, while the other is to partner with an Employer of Record (EOR). The choice between these methods depends on various factors, such as the number of employees being hired, time constraints, budget considerations, and long-term expansion plans in the US.

Option 1: Hiring Under Your Own US Entity

Setting up a US entity gives you complete control over your US operations. You’ll hire directly and manage payroll while following local labor laws. This option is ideal for companies planning a sizable US team and aiming for a long-term presence.

However, establishing a legal entity requires a deep understanding of local employment and tax regulations. It is a time-consuming and expensive process. Only pursue this option if you have the necessary human and capital resources and a trusted employment partner.

Foothold America offers two solutions designed to simplify employing staff in the US: PEO+ Cross-Border Support™ and People Partnership Service (PPS). These services cater to different needs, so you can choose the best fit for your company’s goals and resources.

PEO+ Cross-Border Support™: For companies seeking a more streamlined solution, Foothold America’s PEO+ service acts as a co-employer with your company, taking on many administrative burdens associated with employing staff in the US. This co-employment relationship allows us to handle a wide range of tasks, including comprehensive employee payroll, withholding, and payment of employer payroll taxes, submission of US employee wage tax documents, pre-tax calculations for tax-favored benefits, comprehensive considerable employer benefits, workers’ compensation insurance, general Human Resource guidance & more.

Read more: PEO+ Cross-Border Support™

PEO Alternative PPS: If you prefer to be the direct employer of your US workforce, our PPS offering provides comprehensive HR support to simplify your operations. We’ll handle tasks like payroll processing, benefits administration, and local HR compliance, allowing you to focus on your core business objectives.

Read more: PEO Alternative – PPS

Option 2: The Fast Track - Partnering with a US Employer of Record (EOR)

A popular hiring option is to partner with an Employer of Record (EOR) in the US to bypass the complexities of entity establishment. An EOR functions as a third-party organization that becomes the legal employer of your US workforce, taking care of all employer-related tasks while you focus on day-to-day operations.

By collaborating with an EOR, you can rely on their expertise to handle hiring, onboarding, payroll, benefits administration, and compliance with federal and state employment regulations. Partnering with an EOR offers a cost-effective turn-key solution to hiring employees in the US without the challenges of establishing a legal entity.

Learn more: What Is an Employer of Record (EOR)?

Think Short-Term? US Contractors…

Need specialized talent for a specific project? Hiring independent contractors in the US could be your answer. Contractors offer flexibility: you tap into US expertise without diving into complex labor laws.

But wait! A quick word on classification: In the US, there’s a strict line between contractors and employees. Misclassify and you face fines, back pay, and legal woes.

Here’s the catch: US tax law says contractors must control their work methods and schedules. So, how do you navigate this tightrope? Read more below!

Misclassification: Employees vs. contractors in the US

Hiring contractors in the US can offer flexibility, but misclassifying an employee as a contractor carries hefty risks. Back taxes, penalties, and lawsuits can turn your “cost-saving” measure into a major headache.

So, how do you know if you’re crossing the line? The IRS provides a checklist, but it’s more like a guideline than a guarantee. To truly navigate the murky waters of worker classification, you need a deeper understanding.

Here’s the breakdown:

The Three Pillars:

- Control: Does the worker set their own schedule, use their own tools, and have independent control over their work?

- Financial Aspects: Who pays for expenses and benefits? Does the worker have a significant investment in their business?

- Relationship: Is it long-term and ongoing, or project-specific? How integrated is the worker with your team and operations?

Remember: It’s not just a black and white answer. Each factor carries weight, and the IRS considers the totality of the circumstances. To ensure compliance, businesses can seek guidance from a specialized partner, like an employer of record (EOR).

How much does it cost to hire an employee in the US?

Hiring an employee in the US comes with additional costs beyond their base salary. Employers contribute 6.2% and 1.45% of an employee’s salary to Social Security and Medicare, respectively. Additionally, a 6% tax applies to the first $7,000 of their annual salary for Federal Unemployment Tax (FUTA).

It is important to note that these are minimum amounts. Individual states may have additional mandatory payroll contributions with varying State Unemployment Tax (SUTA) rates. Therefore, the total employer cost can vary depending on the employee’s location.

Unsure about the costs involved in hiring US employees? Skip the generic calculators and get a custom-made budget projection from our US Expansion Advisors.

Looking for additional USA-specific insights? Consider these resources:

- Department of Labor (DOL): https://www.dol.gov/

- Internal Revenue Service (IRS): https://www.irs.gov/

- National Association of State Workforce Agencies (NASWA): https://www.naswa.org/

What to know before hiring employees in the US

To compliantly hire talent in the USA, employers must navigate the US employment laws relating to payroll taxes, statutory employee benefits, and worker classification.

Unlike other countries, the US has a federal-state system for employment law. This means you’ll need to juggle national rules with the specific regulations of each state where you plan to hire.

Understanding Federal and State Employment Laws

The United States, unlike many other countries, has a complex employment legal system. It combines federal laws with individual state regulations, making it challenging to manage a distributed workforce.

Employment law in the United States

Expanding your business to the US? Fantastic! But before you start wooing talent, it’s crucial to understand the unique legalities of US employment law. Here’s a quick overview of key aspects:

At-Will Employment and Termination: Remember the “can do” spirit? US employment is largely at-will, meaning both employer and employee can end the relationship at any time (as long as it is not based on illegal discrimination or retaliation), with some exceptions in certain states.

- Minimum Wage: The federal minimum is $7.25 per hour (for covered nonexempt workers), but be sure to check state laws – some, like New York, boast a higher minimum wage of $15 per hour.

- Working Hours: While there’s no federal limit on work hours, the standard workweek is 40 hours (typically 8 hours a day, 5 days a week).

- Overtime: Hourly employees earn overtime pay (1.5 times their regular rate) for exceeding 40 hours in a week. Salaried employees may be exempt, but state laws can differ, so always apply the higher standard.

- Severance: No federal mandate, but many employers offer severance for goodwill. Some states require it in specific situations like plant closures or mass layoffs.

Remember: This is just a glimpse into the US employment landscape. For deeper dives and state-specific nuances, consult with Foothold America. Our expertise can help you navigate the intricacies of US employment law and ensure your hiring practices are fully compliant.

Payroll tax in the US

Hiring in the US involves more than just salaries. Once an employee begins receiving wages, the employer is responsible for withholding taxes, such as income and FICA taxes, and making contributions to government funds like Social Security, Medicare, unemployment insurance, and worker’s compensation. Here’s a simplified breakdown:

- Social Security: Provides retirement income for workers. Both employers and employees contribute 6.2% of wages up to the taxable maximum, which in 2024 is $168k . Some states tax these benefits.

- Medicare: Medicare is federal health insurance for adults aged 65 or older and younger people who receive disability benefits. Employers and employees each contribute 1.45%.

- Federal and State Unemployment: The Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) provide compensation to workers who have lost their jobs. Employers generally pay 6% on the first $7,000 of wages, plus state-specific rates.

- Workers’ Compensation: Provides medical care and payments to employees injured or sick on the job. Employers pay premiums, with rates varying by state and industry.

- Income Tax: Employees must pay state and federal taxes on their earned income.

– Federal Income Tax: Employees pay federal income taxes on their earned income. These taxes follow a progressive system, with seven tax brackets ranging from 10% to 37%. This means that higher earners pay a larger percentage of their income in taxes compared to lower earners.

– State Income Tax: In addition to federal taxes, employees also pay state income taxes. These taxes vary significantly from state to state, with some states imposing a flat tax rate and others utilizing multiple tax brackets similar to the federal system. There are currently seven states that levy a state income tax on individuals: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming.

Employee benefits in the US

Unlike payroll taxes, the US doesn’t have a national standard for employee benefits. Instead, you’ll encounter a patchwork of state-specific requirements and employer-driven perks. This can be confusing, especially compared to countries with standardized benefits. To remain competitive in attracting and retaining top talent, employers may need to consider offering a comprehensive benefits package that goes beyond what is legally required.

Read more: Guide to Required Employee Benefits in the US

Leave Entitlements:

- No federal mandate: Unlike many countries, the US doesn’t guarantee paid leave.

- Family and Medical Leave Act (FLMA): Companies with 50+ employees must offer unpaid, job-protected leave for qualified reasons, but it’s unpaid.

- State variations: Watch out! 18 states mandate paid sick leave, and others have different requirements.

- Paid leave: Many companies offer paid leave (vacation, family leave) based on their own policies, adding further complexity.

Social Security:

- Federally mandated: Both employers and employees contribute to this retirement income program.

- Some state taxes: While rare, 9 states have additional taxes on Social Security benefits.

Healthcare:

- Federal Affordable Care Act (ACA): Companies with 50+ employees must provide minimum essential coverage, but complexity abounds.

- State variations: Some states have additional laws in place to improve employee health insurance. For example, Massachusetts mandates specific health coverage levels for employees.

Multi-state operations? Brace yourself! Navigating different health insurance plans and providers across states requires extra effort.

US Hiring Challenges? Foothold America Can Help.

Expanding to the USA is thrilling, but hiring can turn into a regulatory labyrinth. Drowning in paperwork, stressed about compliance, and worried about legal pitfalls? You’re not alone.

The US Hiring Struggle is Real:

- Complex regulations: Federal and state laws are intricate, leading to costly mistakes.

- Time-consuming setup: Setting up payroll, employee taxes, and benefits takes precious time away from growth.

- Compliance risks: Non-compliance can result in hefty fines and penalties.

Worry-Free, Compliant Hiring Starts Here:

There are three main ways we can help you navigate the complexities of US employment: Employer of Record (EOR), PEO+ Cross-Border Support™, and People Partnership Service (PPS).

1. Employer of Record (EOR): Our EOR solution is ideal for companies who want to hire US employees quickly and efficiently without the burden of setting up a legal entity. We’ll handle everything from onboarding and payroll to tax administration and compliance, allowing you to focus on finding top talent and growing your business.

2. PEO+ Cross-Border Support™: For companies seeking a more streamlined solution with co-employment benefits, our PEO+ service acts as a co-employer, taking on many administrative burdens while allowing you to maintain a close relationship with your US staff.

3. People Partnership Service (PPS): If you prefer to be the direct employer of your US workforce but need support with HR tasks, our PPS offering provides comprehensive HR support to simplify your operations.

No matter your specific needs, we have a solution to help you build your US team with confidence. Partner with us and experience peace of mind as we take care of onboarding, management, and compliance for your US team.

Contact us today to discuss your requirements and find the perfect fit for your business.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.