EOR vs PEO: Comprehensive Comparison Guide for US Expansion

Expanding your business into the United States represents an exciting opportunity to tap into the world’s largest economy. However, navigating the complex landscape of US employment regulations, tax codes, and compliance requirements can be daunting for international companies. Two popular solutions have emerged to help businesses manage their US workforce: Employer of Record (EOR) and Professional Employer Organization (PEO) services.

While these terms are sometimes used interchangeably, they represent fundamentally different employment and HR management approaches. Understanding the distinctions between EOR vs PEO is crucial for deciding which model best suits your US expansion strategy.

This comprehensive guide will explore the key differences between an Employer of Record and a Professional Employer Organization, examining their unique features, advantages, limitations, and ideal use cases. By the end, you’ll clearly understand which solution best aligns with your business goals for US expansion.

What is an Employer of Record (EOR)?

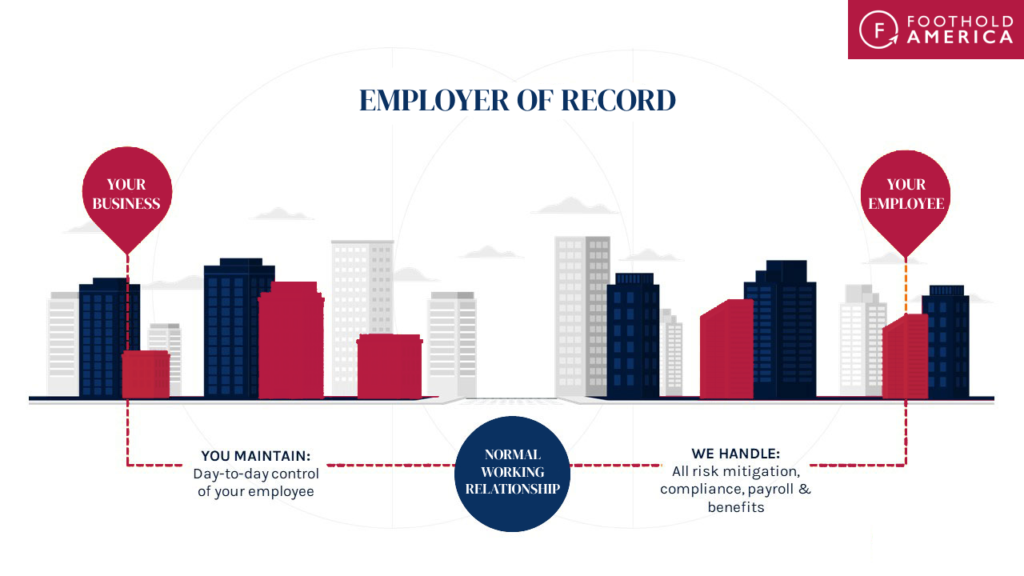

An Employer of Record (EOR) is a third-party organization that takes on the legal responsibility of employing workers on behalf of another company. When you partner with an EOR, they become your workforce’s official, legal employer in the United States while you maintain day-to-day operational control over your employees.

“An EOR provides international businesses with a turnkey solution for hiring in the US, eliminating the need to independently navigate complex entity setup, state registrations, and employment compliance challenges. We handle everything from onboarding to offboarding, allowing you to focus on growing your business.” — Angelique Soulet-Bangurah, Head of EOR Services & Talent Acquisition Lead at Foothold America.

How an EOR Works

The EOR establishes and maintains a legal entity in the United States, allowing international companies to hire US-based employees without setting up their own US entity. The EOR handles many aspects of legal employment, including:

- Payroll processing and management

- Tax withholding and filing

- Benefits administration

- Employment agreements and compliance

- Workers’ compensation insurance

- HR support and guidance

EOR Responsibilities

An EOR assumes comprehensive legal responsibilities as the employer, including:

- Legal Compliance: Ensuring adherence to federal, state, and local employment laws and regulations. The EOR stays current with constantly changing regulations across all states where your employees work, protecting your business from potential penalties and legal issues.

- Payroll Management: Processing payroll, calculating tax withholdings, and distributing employee payments. This includes managing complicated tax calculations across multiple states, ensuring accurate and timely payments, and providing detailed reporting.

- Tax Administration: Managing tax filings, payments, and compliance with tax regulations. The EOR handles all employment tax obligations, including federal, state, and local tax filings, reducing your administrative burden and compliance risks.

- Benefits Management: Administering employee benefits packages, including health insurance and retirement plans. The EOR can provide access to competitive benefits that might otherwise be unavailable to smaller employers, helping you attract and retain top talent.

- Risk Mitigation: Handling employment-related risks and liabilities. The EOR assumes responsibility for employment claims, workers’ compensation, and other potential liabilities, significantly reducing your exposure to legal and financial risks.

- HR Support: Providing HR guidance and support for various employment matters. This includes assistance with employee onboarding, policy development, performance management, and other HR functions, giving you access to expertise without needing an in-house HR department.

When to Use an EOR

An EOR is particularly beneficial in the following scenarios:

- International Expansion: When expanding into the US market without establishing a legal entity

- Testing New Markets: For companies looking to test the US market before making a significant investment

- Quick Market Entry: When speed of entry is crucial for business operations

- Compliance Assurance: For businesses concerned about navigating complex US employment laws

- Small-Scale Operations: When hiring a small number of employees in the US

- Risk Management: For companies seeking to minimize employment-related risks and liabilities

What is a Professional Employer Organization (PEO)?

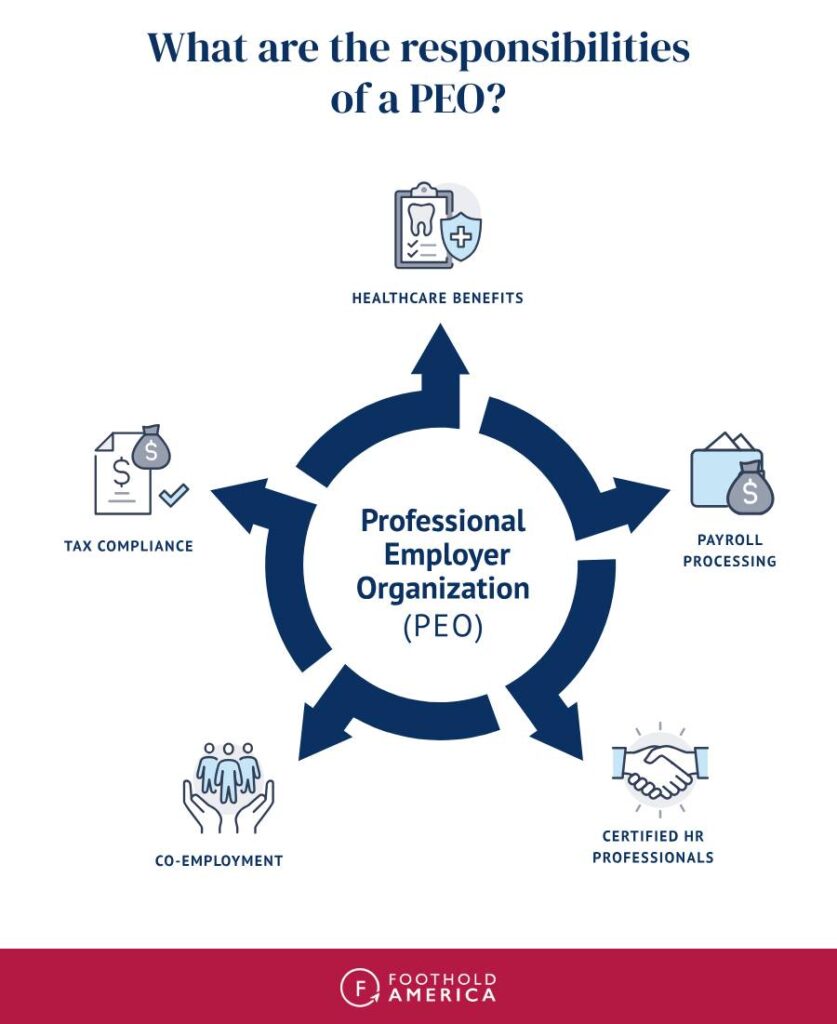

A Professional Employer Organization (PEO) is a company that provides comprehensive HR solutions through a co-employment arrangement. In this model, the PEO shares employer responsibilities with the client company, creating a partnership where both entities have specific roles in managing the workforce.

“A PEO relationship allows businesses with US entities to focus on their core operations while we handle HR administration, compliance, and benefits management complexities. Our PEO+ solution goes beyond traditional PEO services to address international companies’ unique challenges when operating in the US market.” — Robert R. Esquijarosa, Head of Service Implementation at Foothold America.

How a PEO Works

Unlike an EOR, a PEO operates on a co-employment model, where the PEO and the client company share employer responsibilities. The client company maintains its legal entity in the US and retains primary control over its workforce, while the PEO handles various HR functions and administrative tasks.

To work with a PEO, your company must be a US entity, have a federal employer identification number (EIN), and have a US bank account. This is a fundamental requirement that distinguishes PEOs from EORs.

PEO Responsibilities

A PEO typically handles the following responsibilities:

- HR Administration: Managing HR-related paperwork and administrative tasks. The PEO streamlines HR processes, reduces paperwork, and ensures proper documentation for all employment matters, freeing your staff to focus on strategic priorities.

- Payroll Processing: Handling payroll calculations, deductions, and tax withholdings. The PEO ensures accuracy and timeliness in all payroll functions, including complex calculations for various benefit deductions, tax withholdings, and garnishments across multiple states.

- Benefits Administration: Providing access to comprehensive benefits packages, often at competitive rates. By aggregating employees from multiple client companies, PEOs can negotiate better rates and offer more robust benefits options than many companies could secure.

- Compliance Support: The PEO assists with adhering to employment laws and regulations. It helps navigate the complex landscape of federal, state, and local employment regulations, reducing the risk of non-compliance penalties and legal complications.

- Risk Management: Helping mitigate employment-related risks. This includes guidance on workplace safety, employee relations, and other areas that could expose your business to potential liabilities, creating a safer and more compliant work environment.

- Employee Training: Offering training programs and resources for workforce development. Many PEOs provide access to learning platforms, workshops, and other professional development resources that help improve employee skills and satisfaction.

When to Use a PEO

A PEO is often the best choice in these scenarios:

- Established US Presence: For companies that already have a legal entity in the US

- Administrative Relief: When seeking to reduce the administrative burden of HR management

- Benefits Enhancement: For businesses looking to offer competitive benefits packages

- Cost Efficiency: When seeking to leverage economies of scale for HR services

- Growth Support: For companies in growth phases that need scalable HR solutions

- Compliance Assistance: When requiring support with complex US employment regulations

PEO+ Cross-Border Support™: Foothold America’s Enhanced Solution

Foothold America’s PEO+ Cross-Border Support™ goes beyond traditional PEO services to address the unique challenges international companies face when expanding into the US market. This innovative solution builds upon the core strengths of standard PEO offerings while providing specialized support tailored to the needs of businesses with cross-border operations.

“We developed PEO+ Cross-Border Support™ after recognizing that international companies face specific challenges that aren’t adequately addressed by traditional PEOs. Our solution combines comprehensive HR services with specialized cross-border expertise, making it the ideal choice for international businesses with established US entities.” — Robert R. Esquijarosa, Head of Service Implementation at Foothold America.

How PEO+ Differs from Standard PEO Services

Unlike conventional PEO offerings, PEO+ Cross-Border Support™ provides:

- International Expertise: Specialized knowledge and experience in managing the complexities of cross-border employment, taxation, and compliance.

- Dedicated Support Near You: HR & Client Service Managers located in the UK and Europe for your convenience, while our US team supports your US workforce. This ensures responsive assistance in your time zone and cultural understanding of your home country and US operations.

- Enhanced Administrative Support: In addition to standard PEO services, PEO+ handles additional tasks like payroll grid management, bespoke employment offers, and company policies reducing your administrative burden.

- Strategic Cost Optimization: Leveraging expertise and buying power to negotiate the best rates on benefits, worker’s compensation insurance, and other services, comparing options in the private market to ensure competitive rates.

- Cultural Integration Guidance: Resources and support to help foster cultural understanding and integration within diverse teams, creating a more cohesive and productive work environment.

PEO+ represents a more comprehensive solution specifically designed for international companies with established US entities that require specialized support to navigate the complexities of cross-border operations.

Key Differences Between EOR and PEO

Understanding the fundamental differences between an Employer of Record and a Professional Employer Organization is essential for making the right choice for your business. Here’s a detailed comparison of the key distinctions:

1. Legal Employment Relationship

EOR: Acts as the full legal employer of your workforce. The EOR assumes employer liabilities and responsibilities, with your company maintaining operational control over day-to-day activities.

PEO: Establishes a co-employment relationship where the PEO and your company share employer responsibilities. Your business remains the common law employer, while the PEO handles specific HR and administrative functions.

2. Entity Requirements

EOR: No need for your company to establish a legal entity in the United States. The EOR leverages its existing legal infrastructure to employ workers on your behalf.

PEO: Requires your company to have an established legal entity in the United States, a federal employer identification number (EIN), and a US bank account.

3. Employer Liabilities

EOR: Bears legal responsibility for employment-related liabilities, including compliance with labor laws, tax regulations, and employment standards.

PEO: Shares employer liabilities with your company through the co-employment arrangement, with specific responsibilities outlined in the service agreement.

4. Control Over Employment Decisions

EOR: Your company maintains operational control over employees, including daily management, while the EOR handles employment administration. However, due to their legal employer status, the EOR may have the final say on certain employment decisions. For example, if an employee cannot demonstrate their right to work in the US, the EOR wouldn’t hire them

PEO: Your company retains more control over employment policies and decisions, with the PEO providing support and guidance on HR matters.

5. Compliance Responsibility

EOR: Takes responsibility for ensuring compliance with federal, state, and local employment laws and regulations.

PEO: Shares compliance responsibilities with your company, often providing guidance and support while your business maintains some liability.

6. International vs. Domestic Focus

EOR Typically facilitates international employment, making it ideal for companies expanding into new markets without a local entity.

PEO: Primarily focused on domestic employment solutions, often serving companies already established in the US market.

7. Cost Structure

EOR: Generally charges a flat fee per employee or a percentage of the employee’s salary, often resulting in higher costs due to the assumption of liability and comprehensive nature of the services provided.

PEO: Usually charges a per-employee fee, potentially offering cost advantages through economies of scale. PEOs usually charge a lower rate because the employer risk is shared.

8. Benefits Administration

EOR: Provides benefits packages directly to employees as the legal employer.

PEO: Offers access to benefits through shared plans, potentially at more competitive rates than small company plans due to the pooling of employees across multiple client companies.

Comparison Table: EOR vs PEO

Feature | Employer of Record (EOR) | Professional Employer Organization (PEO) |

Legal Relationship | Legal employer | Co-employer |

US Entity Required | No | Yes |

Employer Liabilities | Primary responsibility | Shared responsibility |

Compliance Management | Complete compliance management | Shared compliance responsibilities |

Focus | International expansion | Domestic HR support |

Cost Structure | Typically higher cost | Often more cost-effective for scaling workforces |

Best For | Companies without US entities | Companies with established US presence |

Pros and Cons of EOR vs PEO

Employer of Record and Professional Employer Organization services offer distinct advantages and limitations. Understanding these pros and cons is essential for determining which solution best aligns with your business needs and objectives.

Employer of Record (EOR) Pros and Cons

Pros of Using an EOR

✓ No Entity Required: Eliminates the need to establish a legal entity in the US, saving time and resources. You can start hiring immediately without the lengthy and costly process of entity formation, state registrations, and banking setup.

✓ Full Compliance Management: Ensures compliance with all applicable employment laws and regulations. The EOR stays current with constantly changing federal, state, and local regulations, protecting your business from potential penalties and litigation.

✓ Risk Mitigation: Reduces employment-related risks and liabilities for your company. The EOR assumes responsibility for employment claims, workers’ compensation issues, and other potential legal challenges.

✓ Rapid Market Entry: Enables quick entry into the US market without lengthy setup processes. You can hire employees in a few days rather than the months required for entity establishment.

✓ Simplified Administration: Handles all employment-related administrative tasks. The EOR manages everything from onboarding, offboarding, payroll processing, benefits administration, and tax filings.

✓ Focus on Core Business: Allows your company to focus on core business activities while the EOR manages employment matters. Your team can concentrate on product development, sales, and growth strategies rather than administrative HR functions.

Cons of Using an EOR

✗ Higher Costs: Generally more expensive than PEO services due to the comprehensive nature of the employment relationship. The added convenience and risk reduction come at a premium compared to other HR solutions.

✗ Limited Control: Less control over certain HR policies and employment decisions. As the legal employer, the EOR has final authority on some employment matters, which may not always align perfectly with your preferences.

✗ Potential Brand Dilution: Employees are legally employed by the EOR, which might affect company culture and brand identity. This arrangement can sometimes create a perception of separation between workers and your core business.

Professional Employer Organization (PEO) Pros and Cons

Pros of Using a PEO

✓ Cost-Effective HR Solution: Often more economical for businesses with an established presence and larger workforces. PEOs leverage economies of scale to provide HR services at lower rates than maintaining an in-house department.

✓ Competitive Benefits: Access comprehensive benefits packages at competitive rates through economies of scale. PEOs can negotiate better terms with insurance providers and other benefits vendors by pooling employees from multiple companies.

✓ Retained Control: Maintains greater control over employment policies and decisions. As the primary employer, you preserve authority over most aspects of the employment relationship while receiving support from the PEO.

✓ HR Expertise: Provides access to HR specialists and resources. PEOs employ experts in various HR disciplines, giving you the benefit of specialized knowledge without the cost of hiring these professionals directly.

✓ Scalable Support: Offers scalable HR solutions that grow with your business. PEOs can easily accommodate workforce expansions or reductions, providing consistent support as your needs evolve.

✓ Compliance Assistance: Helps navigate complex employment regulations and requirements. PEOs stay current with changing laws and guides to ensure your practices remain compliant.

Cons of Using a PEO

✗ Entity Requirement: Your company must have an established legal entity in the US. This prerequisite means you must complete the entity formation process before engaging a PEO, which can be time-consuming and costly.

✗ Shared Liability: Maintains some employer liabilities and responsibilities. The co-employment relationship means your company still bears certain legal risks and obligations related to employment.

✗ Integration Complexities: This may require significant integration with existing systems and processes. Adopting a PEO’s systems and workflows can sometimes create friction with your established operational practices.

✗ Potential Service Variations: Quality and scope of services can vary significantly between providers. Not all PEOs offer the same expertise, support, or service quality, making provider selection crucial.

When to Choose an EOR vs PEO for US Expansion

The decision between an Employer of Record and a Professional Employer Organization should be based on your company’s specific circumstances, expansion goals, and operational requirements. Here’s a framework to help you determine which solution is right for your business.

Choose an Employer of Record (EOR) When:

- You Don’t Have a US Entity: If your company hasn’t established a legal entity in the United States, an EOR provides a turnkey solution for employing US workers.

- You Need Quick Market Entry: When speed is essential for your expansion strategy, an EOR eliminates the lengthy process of entity establishment, allowing you to hire employees rapidly.

- You’re Testing the Market: If you’re exploring the US market before making a significant investment, an EOR offers flexibility without committing to permanent infrastructure.

- You Have a Small US Workforce: For companies hiring a limited number of employees in the US, an EOR can be more practical than establishing and maintaining a legal entity.

- You Want to Minimize Compliance Risks: If navigating complex US employment laws is a concern, an EOR assumes full responsibility for compliance management.

- You Prefer Simplified Administration: When you want to focus on core business activities rather than employment administration, an EOR handles all HR-related tasks.

Choose a Professional Employer Organization (PEO) When:

- You Have an Established US Entity: If your company already has a legal presence in the United States, a PEO can enhance your HR capabilities without changing your corporate structure.

- You Want Cost-Effective HR Solutions: A PEO often provides more cost-effective HR services through economies of scale for businesses with a larger workforce.

- You Seek Competitive Benefits: If offering comprehensive employee benefits is a priority, a PEO can provide access to high-quality benefits packages at competitive rates.

- You Prefer Greater Control: A PEO’s co-employment model offers more autonomy when maintaining control over HR policies and employment decisions, which is essential.

- You Need Scalable Support: If your business grows, a PEO can provide scalable HR solutions that adapt to your changing needs.

- You Value Specialized HR Expertise: When access to HR specialists and resources is a priority, a PEO offers comprehensive HR support and guidance.

- You’re Planning Long-Term US Operations: A PEO can be a strategic partner for sustainable growth for companies committed to a long-term presence in the US market.

Transitioning Between EOR and PEO Models

As your business evolves in the US market, your employment needs may change, requiring a transition between EOR and PEO models. This evolution is common as companies move from initial market entry to established operations, and understanding the considerations involved can help ensure a smooth transition.

Why Companies Transition from EOR to PEO

Many international businesses begin their US expansion journey with an EOR service, allowing for quick market entry without the complexities of entity establishment. As their US presence grows, several factors may prompt a transition to a PEO model:

- Growth in US Operations: A maturing business with increasing revenue and headcount often benefits from the economies of scale offered by a PEO.

- Establishment of US Entity: Once a company establishes a legal entity in the US, a PEO becomes a viable option that offers greater control and potential cost advantages.

- Desire for Greater Control: As operations stabilize, companies often seek more control over employment policies, benefits structures, and HR management.

- Long-Term Commitment: A transition to a PEO often signals a more profound, long-term commitment to the US market, reflecting confidence in continued growth.

- Complexity of Operations: As operations become more complex, the flexibility and customization available through a PEO becomes increasingly valuable.

“The transition from an EOR to a PEO is a significant milestone in a company’s US expansion journey. It reflects growth, stability, and a long-term commitment to the market. At Foothold America, we’ve guided hundreds of international companies through this evolution, ensuring continuity for their employees and operations while positioning them for continued success.” — Robert R. Esquijarosa, Head of Service Implementation at Foothold America.

The Transition Process

Transitioning between employment models requires careful planning and coordination. Key considerations include:

Timing: Planning the transition coincides with natural business cycles can minimize disruption. Most companies should allocate two to three months for a complete transition.

Employee Communication: Clear communication with employees about the change, its implications, and benefits is essential for maintaining morale and productivity.

Benefits Continuity: It is crucial for satisfaction and retention to ensure that employees experience minimal disruption to their benefits during the transition.

Regulatory Compliance: Navigating the regulatory requirements for changing employment models requires expertise in EOR and PEO structures.

Administrative Coordination: Coordinating the transfer of employment records, payroll data, and tax information requires meticulous attention to detail.

Foothold America’s Transition Support

Foothold America offers specialized expertise in transitioning between EOR and PEO+ models, providing comprehensive support. What sets us apart is our experience with both models under one roof, allowing for a seamless transition without the complications of changing providers.

Our transition support includes:

- Strategic Planning: We will work with you to develop a transition timeline that aligns with your business goals and minimizes disruption.

- Employee Communication: Providing guidance and resources for communicating the change to your workforce positively and reassuringly.

- Benefits Management: Ensuring continuity in employee benefits during the transition, minimizing changes to plans and providers where possible.

- Compliance Guidance: Navigating the regulatory requirements associated with the transition to maintain full compliance throughout the process.

- Data Transfer: Handling the secure transfer of all employment records, payroll history, and tax information between systems.

- Ongoing Support: Providing continued assistance as your team adjusts to the new employment model, ensuring a smooth adaptation period.

Switch with Confidence: Transitioning from Other EOR and PEO Providers

Beyond transitions between our own EOR and PEO+ services, Foothold America also specializes in helping companies transition from other providers. If you’re currently working with another EOR or PEO provider and experiencing challenges with service quality, responsiveness, or expertise, we can guide you through a smooth transition to our services. Our experienced team will work closely with your current provider to ensure all employee data, payroll information, and benefits details are transferred accurately and securely, making the change virtually effortless for you and your employees. We handle all the complex coordination, paperwork, and compliance requirements, allowing you to enjoy improved service and support without disruption to your operations. Whether you’re transitioning from an EOR to our PEO+ solution as your US presence grows, adjusting your employment strategy to meet changing business needs, or moving from another provider to Foothold America, our experienced team ensures a smooth and compliant evolution of your US workforce management.

Cost Comparison: EOR vs PEO Pricing Models

Understanding the cost structures of Employer of Record and Professional Employer Organization services is essential for making a financially sound decision for your business. Here’s a detailed comparison of the typical pricing models:

EOR Pricing Models

Employer of Record services typically follow these pricing structures:

- Flat Fee Per Employee: Many EORs charge a fixed monthly fee for each employee, regardless of salary level. These fees typically range from $500 to $1,000+ per monthly employee.

- Percentage of Salary: Some EORs charge a percentage of the employee’s salary, usually ranging from 5% to 15%, depending on the level of service and location.

- Tiered Pricing: Certain EORs offer tiered pricing models, with rates decreasing as the number of employees increases.

- Additional Fees: Some EORs may charge setup fees, termination fees, or fees for additional services beyond standard offerings.

Foothold America offers transparent pricing for its EOR services. This straightforward approach eliminates surprise costs and provides predictability for international businesses planning their US expansion.

PEO Pricing Models

Professional Employer Organization services commonly use these pricing approaches:

- Percentage of Payroll: Industry experts estimate that PEO costs typically range between 2% and 12% of wages. The actual percentage varies based on the specific services included and the size of your workforce.

- Per-Employee Structure: Some PEOs may structure their fees on a per-employee basis rather than as a percentage of payroll.

- Administrative Fees: Some PEOs charge administrative fees in addition to the payroll percentage, which covers specific services or administrative tasks.

- Service Tiers: Many PEOs offer different service tiers with varying price points based on the services’ comprehensiveness.

It’s important to note that businesses with 20-75 employees are typically the sweet spot for full-service PEOs, unlocking their full potential to handle all HR needs. While most PEOs require a minimum of five employees, Foothold America’s PEO+ Cross-Border Support™ stands out by accommodating companies with as few as one employee on payroll and two for benefits. This makes it an exceptionally accessible solution for international businesses in the earliest stages of US expansion.

Cost Comparison Factors

When comparing the costs of EOR and PEO services, consider these key factors.

- Total Workforce Size: While PEOs offer economies of scale, direct hiring may be more cost-effective once your workforce exceeds 100 employees.

- Salary Levels: If using percentage-based pricing, higher salaries will result in higher costs.

- Service Customization: The ability to select only the services you need rather than standard packages can significantly impact overall cost-effectiveness.

- Geographic Coverage: Not all EOR or PEO providers cover all 50 states, so ensure your chosen provider supports your target locations.

- Contract Length: Longer-term commitments may qualify for discounted rates with both PEO and EOR services.

- Hidden Costs: Be aware of potential additional charges for services not included in the base package.

Which is More Cost-Effective?

The relative cost-effectiveness of EOR vs PEO services depends on your specific circumstances.

EOR services tend to be more cost-effective when:

- You have fewer than 10 employees

- You don’t have a US legal entity

- You need rapid deployment

- You value simplified administration and risk management

PEO services tend to be more cost-effective when:

- You have an established US entity

- You have more than 10 employees

- You’re seeking competitive benefits packages

- You value long-term HR partnership

The total cost consideration should also include indirect expenses and benefits, such as time savings, risk reduction, and access to expertise, which can significantly impact each solution’s overall value proposition.

Foothold America: Your Trusted Partner for US Expansion

When navigating the complexities of US expansion, having a knowledgeable and experienced partner can make all the difference. Foothold America is a premier provider of Employer of Record (EOR) services and PEO+ Cross-Border Support™, specifically designed to meet the unique needs of international companies expanding into the United States.

“At Foothold America, we understand that expanding into the US market isn’t just about employment paperwork—it’s about building a foundation for growth. Our team of experts has helped hundreds of international companies successfully establish and scale their US operations. What sets us apart is our people-first approach. We’re not just a portal; we’re real people with extensive experience who walk alongside our clients throughout their expansion journey.” — Joanne Farquharson, President and CEO of Foothold America.

Why Choose Foothold America?

Foothold America offers several distinct advantages that set it apart from other service providers:

- US Market Specialization: Unlike global providers who cover multiple countries with varying levels of expertise, Foothold America focuses exclusively on the US market. This specialization provides deep, state-specific knowledge of employment laws, tax regulations, and business practices that generalist providers simply can’t match.

- Flexible Solutions: Whether you need an EOR service for immediate market entry or PEO+ support for your established US entity, Foothold America offers tailored solutions to meet your specific expansion goals. As your business evolves, we can seamlessly transition you between services without requiring you to change providers—a significant advantage since most companies typically must switch providers when moving from EOR to PEO services.

- Human Connection: Where many providers rely on portals and automated systems, Foothold America provides dedicated support from real people with real expertise. Our HR & Client Service Managers are located in the UK and Europe for your convenience, while our US team supports your US workforce, ensuring you always have knowledgeable assistance in your time zone.

- Comprehensive Services: From payroll and benefits administration to compliance management and HR support, Foothold America provides end-to-end solutions for your US workforce needs. We handle the complex details so you can focus on growing your business.

- Transparent Pricing: Foothold America offers clear and competitive pricing with no hidden fees or unexpected costs. Our straightforward approach eliminates surprises and allows for accurate budgeting of your US expansion.

- Proven Track Record: Having helped hundreds of international companies establish and grow their US presence, Foothold America brings valuable experience and insights to every client relationship. Our expertise spans industries, company sizes, and states, ensuring we can address your challenges and opportunities.

Foothold America’s EOR Service

For companies without a US entity, Foothold America’s EOR service provides a comprehensive solution for employing US workers. With extensive experience managing cross-border employment complexities, our team ensures a smooth and compliant hiring process. As your legal employer, Foothold America handles all employment-related responsibilities, including complete payroll processing, tax withholding, and compliance with federal, state, and local tax regulations. We provide your employees access to comprehensive benefits packages, including health insurance and retirement plans while ensuring adherence to all applicable employment laws and regulations across different states. Throughout your US operations, you’ll receive ongoing HR guidance and support from our experienced team, allowing you to focus on growing your business. At the same time, we manage the complexities of US employment.

Find out more: EOR Service

Foothold America’s PEO+ Cross-Border Support™

For companies with an established US entity, Foothold America offers PEO+ Cross-Border Support™, an innovative solution that goes beyond traditional PEO services to address the specific needs of international businesses. This enhanced service creates a co-employment partnership that shares employer responsibilities while providing comprehensive HR support tailored to cross-border operations. Our specialized knowledge helps manage the unique challenges faced by international companies operating in the US while giving you access to competitive benefits packages designed to attract and retain top talent. We handle administrative tasks and streamline operations, allowing you to focus on your core business activities. Our dedicated support structure sets our PEO+ service apart, with HR & Client Service Managers located in the UK and Europe for your convenience, while our US team supports your US workforce. We also assist with the complexities of US work visas, ensuring a smooth onboarding process for international talent, and offer resources and support to help foster cultural understanding and integration within your US team—creating a cohesive, productive work environment that bridges international boundaries.

Find out more: PEO+ Service

Conclusion: Making the Right Choice for Your US Expansion

Expanding into the US market presents tremendous opportunities for international businesses, but navigating the complexities of US employment requires careful consideration of your options. Choosing between an Employer of Record (EOR) and a Professional Employer Organization (PEO) is pivotal to your expansion strategy, each offering distinct advantages based on your specific circumstances.

For companies without a US entity seeking rapid market entry, an EOR provides the quickest and most streamlined path to establishing a compliant US workforce. This turnkey solution eliminates the complexities of entity formation while providing comprehensive employment support, allowing you to focus on business growth rather than administrative challenges.

For businesses with established US entities looking for enhanced HR support and competitive benefits packages, a PEO or PEO+ solution offers cost-effective services with greater control over employment policies. This co-employment model provides valuable expertise and economies of scale while allowing you to maintain your distinct corporate identity.

The decision ultimately depends on your unique business needs, timeline, budget, and long-term objectives. By carefully considering the factors outlined in this guide, you can select the approach that best positions your company for success in the dynamic US market.

Foothold America stands ready to support your US expansion journey, regardless of your chosen path. With specialized expertise in EOR and PEO+ services, our experienced team provides the guidance, support, and solutions needed to confidently navigate the complexities of US employment.

Don’t leave your US expansion to chance—partner with Foothold America, the trusted leader in US workforce solutions for international businesses. Our team of experts has helped hundreds of companies successfully establish and grow their US operations, and we’re ready to do the same for you.

Contact Foothold America today to discuss your US expansion goals and discover how our specialized EOR and PEO+ solutions can empower your business growth in the world’s largest economy.

FAQ’s EOR vs PEO Services

Get answers to all your questions and take the first step towards a US business expansion.

An EOR takes full responsibility for global payroll processing, including tax calculations, withholdings, and compliance with local labor laws in different jurisdictions. The EOR becomes the legal employer, handling all payroll complexities across new countries. In contrast, a PEO operates through co-employment, providing global payroll services while your company maintains its legal entity. Both solutions offer peace of mind regarding payroll compliance. Still, EORs provide complete management without requiring your entity in each location, making them ideal for global hiring initiatives in unfamiliar markets.

However, small businesses can significantly benefit from both EOR and PEO services in different scenarios; for small businesses expanding internationally without the resources to establish their entity, an EOR partner provides a cost-effective solution for compliant employment in new markets. For small businesses with a US entity, a PEO functions as an outsourced HR department, offering economies of scale for benefits and handling HR functions that would otherwise require a dedicated HR team. Both options allow small businesses to focus on growth while ensuring compliance issues are professionally managed.

With an EOR, the provider assumes most employment liabilities as the legal employer of record, significantly reducing your company’s exposure to compliance issues related to local labor laws. The EOR bears responsibility for proper classification, tax compliance, and adherence to employment regulations. In a PEO arrangement, liabilities are shared through co-employment, with your company maintaining some responsibility for employment decisions and compliance. Your service agreement should clearly outline the division of legal requirements and liabilities. Still, generally, PEOs offer support while your company retains more liability than with an EOR solution.

EOR providers specialize in navigating local compliance across multiple jurisdictions, leveraging their established legal entities and expertise in local labor laws for each market. They handle all compliance aspects without requiring you to develop this knowledge internally. PEO services typically focus on compliance within specific countries where they operate, providing guidance on local laws and regulations through their co-employment model. For companies expanding into multiple states or countries simultaneously, an EOR often provides more comprehensive compliance support, especially for markets where you lack familiarity with legal requirements.

PEO services providers typically offer a more comprehensive range of HR services, functioning as a true extension of your HR department. These services often include recruitment, onboarding, performance management, training and development, strategic HR planning, and standard payroll and benefits administration. EORs focus primarily on employment compliance, payroll, and essential HR functions necessary for legal employment. If you’re seeking a provider to handle HR functions beyond compliance and administration, a PEO may be the best fit for supporting your global workforce over the long term.

Transitioning from an EOR to a PEO typically occurs when your company establishes its own entity in a market and seeks more control over employment relationships. This process requires careful planning to ensure continuous compliant employment and minimal disruption for your workers. The transition involves transferring employment contracts, aligning benefits packages, and adjusting payroll systems. Foothold America manages this transition seamlessly, allowing companies to move between EOR and PEO+ services without changing providers—a significant advantage since most companies typically must switch providers when transitioning between these models.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.