Top Tips: Finding the Best Employer of Record

Hiring employees in the USA can be challenging due to the complex legal and compliance requirements. Misclassifying workers or failing to adhere to local employment laws can lead to serious legal and financial consequences. To navigate this process, businesses can either set up as an employer in the given country or work with an Employer of Record (EOR) that can handle the legal relationship and employment obligations with their employees locally.

While setting up as an employer in each country provides complete control over one’s employment operations, it can be a time-consuming process that can take anywhere from ten weeks to 18 months. Tasks like registering with local tax authorities and labor departments, setting up an entity, creating employment agreements, managing payroll, ensuring compliance with employment legislation, handling ongoing payroll overheads, and staying up-to-date on evolving regulations are all part of it. On top of that, maintaining an employer presence overseas requires an ongoing commitment to stay up-to-date on the latest developments and regulatory changes to ensure the continued success and compliance of the operation.

On the other hand, opting to hire employees through an Employer of Record (EOR) can provide businesses with significant advantages. This approach can help minimize administrative burdens, reduce overhead costs, and ensure legal compliance, eliminating any potential legal ambiguities.

However, choosing the right EOR to partner with can be challenging, and it’s crucial to ask the right questions to determine if a potential EOR is the right fit for your business. In this blog, we’ll take a closer look at 10 essential questions to ask a prospective EOR before hiring them.

What is an Employer of Record?

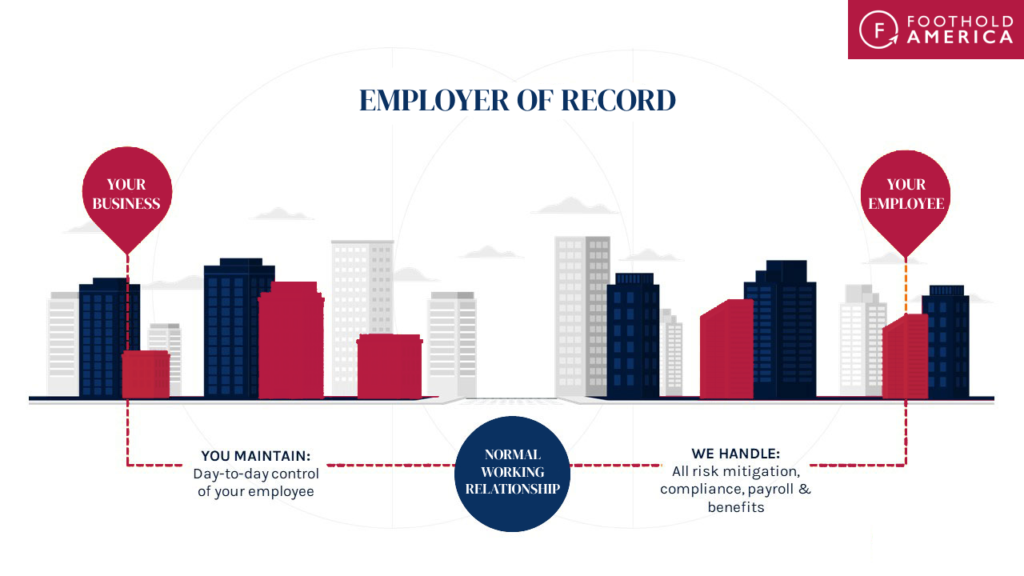

An Employer of Record (EOR) is a third-party organization that assumes the legal responsibility for managing a company’s workforce. The EOR typically manages administrative tasks related to employment such as payroll administration, benefits, compliance, hiring, onboarding, tax reporting, and regulatory filings. The EOR organization allows companies to outsource the burden of managing their employment administration, freeing them to focus on their core business activities. This model can be helpful for companies looking to establish a presence in a new market quickly and cost-effectively, as it eliminates the need to establish a new legal entity. To learn more about how the EOR service works, please click here.

What are the benefits of hiring employees using an Employer of Record service?

Using an Employer of Record service to hire employees offers several benefits. Firstly, it facilitates seamless expansion into new markets and countries, as the Employer of Record takes care of all legal and compliance requirements, such as payroll, taxes, and employment laws. This saves employers the time and effort of navigating complex US regulations. Secondly, an Employer of Record assumes the employer’s responsibilities, reducing the risks associated with employment, such as legal liabilities and HR management. They handle all administrative tasks, allowing businesses to focus on core operations. Additionally, an Employer of Record service offers flexibility, enabling employers to hire and scale up or down quickly without the onboarding complexities associated with traditional employment. The companies that decide to expand to the USA through an EOR can test the market without major investment and do not need to setup a US entity. Another benefit of using an Employer of Record service provider is being able to take advantage of the healthcare offering for your employees in the USA. Overall, partnering with an Employer of Record provides a convenient, efficient, and compliant solution for hiring employees globally.

Read more about the benefits of using an EOR service here.

–

Since different EOR providers have their own unique fee structures and services, the process of selecting a suitable EOR can be challenging. To help in the selection process, we have compiled ten important questions to ask a prospective EOR provider.

1. Will the EOR provider legally employ your worker?

Before delving into other inquiries, it is crucial to assess whether the provider handles local employment. While US employment involves tasks such as cross-border payments and streamlined payroll, having a local employer for your workers is essential. The Employer of Record should handle activities like maintaining a local corporate entity, registering as an employer with tax authorities, processing payroll, filing taxes, providing statutory benefits, and ensuring compliance with HR regulations.

Providers solely offering tools or services for international payments, contractor invoicing, or payroll processing do not offer the comprehensive range of services required for proper legal employment; being the actual employer is essential.

At Foothold America, we tick off all the boxes mentioned above with an experienced team of professionals dedicated to ensuring comprehensive employment services. As a legal Employer of Record, Foothold America manages all aspects of payroll, taxes, compliance, and more, including maintaining a local presence, handling employee benefits, and providing HR support. With a strong emphasis on corporate governance in every entity, Foothold America offers a complete range of services, making it the go-to solution for legal and compliant employment services for businesses looking to hire in the USA.

2. Is the EOR the direct employer, or do they work through partners?

It’s crucial to understand who the legal employer is when employing remote workers through an EOR. Simply offering legal employment in a particular country doesn’t necessarily mean that the EOR is the direct legal employer. They may be working with a partner organization that they will communicate with on your behalf. In such cases, it’s essential to understand who is responsible should something go wrong, how performance-related issues or termination are handled, and how they ensure you know the latest changes in employment and tax legislation. Ultimately, you need to know precisely who is responsible for your employee in the eyes of the local authorities.

Some Employer of Record services opt to work with partners instead of setting up their entities. If they work with partners, you need to know whether you’ll have direct contact with them. Additionally, you need to ask a few questions, such as:

- What happens regarding performance-related issues or termination?

- How do they ensure they receive all data changes for payroll purposes from your end before the partner’s deadline?

- How do they stay up-to-date with employment and tax legislation?

- How do they move money between organizations?

- Have they done their due diligence in choosing their partner?

- How do they ensure their partner does everything right?

Asking these questions ensures that employers work with EOR providers with the best partnership structures and accountability.

3. How are employer obligations split between you and the EOR?

As mentioned earlier, an Employer of Record (EOR) takes on specific obligations related to local compliance, but other aspects of the “actual work” remain the employer’s responsibility. This includes setting goals, conducting 1:1 meetings, and managing learning and development. When an EOR claims to assist with HR compliance and navigating local regulations, it’s important to investigate the details.

Different states have their own specific obligations, and the division of responsibilities between the employer and EOR may vary. It’s crucial to clarify all the details and fine print to ensure a clear understanding of the responsibilities.

At Foothold America, we understand the importance of a clear and defined division of responsibilities between the employer and the Employer of Record (EOR). While Foothold America, as the legal EOR, takes on specific obligations related to local compliance, it’s essential to note that day-to-day aspects of managing employees, such as setting goals and conducting 1:1 meetings, remain the employer’s responsibility. At Foothold America, we assist our clients with HR compliance and provide guidance on navigating local regulations, but there may be certain obligations that the employer is expected to fulfill. We work collaboratively with our clients to ensure an open and transparent relationship and a smooth employment experience. With our comprehensive knowledge of state-specific regulations and commitment to corporate governance, you can trust us to handle your EOR needs while you focus on growing your business.

4. Does the EOR have extensive HR and payroll knowledge and the right processes in place?

For an Employer of Record (EOR) to provide effective assistance with US HR and Payroll, they must have extensive knowledge and experience in US payroll and operations, as well as an in-house HR team to help you. Moreover, they should have a thorough understanding of local employment and tax legislation, including any changes over time. They should be able to present this information in a way that is easy to understand for you, the client.

Investigate if, as part of the sales or onboarding process, you can speak with people who are in these roles and whose primary responsibility is employment compliance. Be prepared to ask questions about local employment law and any related client responsibilities. For instance, pay close attention to their tone and confidence when answering your questions. Do they genuinely grasp the nuances of HR and Payroll operations, or does it feel like they are trying to sell their product to you?

Additionally, ask the EOR if they can provide written materials, such as guides, that you can access at your convenience. This helps ensure that you have the necessary resources to understand local regulations and helps to streamline communication between you and the EOR.

It’s also helpful to inquire about the extent to which the EOR automates and streamlines its services and products. When partnering with an EOR, it’s crucial to understand there is a service element to what they do, which should be easy to access and understand, both for you and your employees. Ultimately, the primary purpose of partnering with an Employer of Record is to allow you to focus on what truly matters to you: running your business without the burdens of HR and administrative tasks.

When partnering with Foothold America as your Employer of Record (EOR), you can rest assured that we have extensive HR and payroll knowledge, along with the right processes in place, to effectively support your US HR and payroll needs. Our team possesses a deep understanding of US payroll and operations, backed by our in-house HR experts who are dedicated to assisting you. We stay up-to-date with local employment and tax legislation, ensuring compliance and providing you with clear and easy-to-understand information. As part of our commitment to transparency, we encourage you to speak with our team members responsible for employment compliance during the sales or onboarding process. They will be more than happy to address any questions you may have and showcase their expertise.

5. Does the EOR company offer a robust benefits package for your employees?

Can your EOR partner offer comprehensive health coverage, including pension packages, to your employees? If you want to attract and retain top talent, it is crucial to consider the type of coverage and benefits you can offer them. One key aspect to evaluate is whether your Employer of Record (EOR) partner can provide a robust benefits package.

Administering employee benefits, particularly health insurance, becomes a complex task when managing a global workforce due to varying regional laws and expectations. EORs excel in navigating these complexities and should efficiently administer a comprehensive range of employee benefits in compliance with state and local laws. This ensures that your employees are well taken care of, which ultimately enhances motivation and loyalty.

At Foothold America, we understand the importance of providing comprehensive benefits to your US-based employees. Our tailored benefits packages encompass a range of offerings, including health insurance, retirement plans, paid time off, and more. We work closely with our clients to ensure that their benefits packages align with their unique needs while remaining compliant with US employment regulations. Our team of experts is well-versed in the intricacies of state-specific requirements, providing invaluable guidance in creating attractive and competitive benefits packages. With Foothold America as your partner, you can trust that your employees will receive the comprehensive benefits they deserve, fostering a motivated and loyal workforce.

How to hire in the US with an EOR

From mitigating risks associated with non-compliance to streamlining payroll and benefits administration, the infographic expertly highlights how an EOR partnership is a cost-effective and efficient solution for businesses looking to expand into the US. This infographic is a must-read resource for any business contemplating international expansion.

6. What support can you expect from the Employer of Record when terminating an employment agreement?

In most countries, there are strict regulations in place to prevent unlawful terminations.Regardless of your worker’s location or the specific situation, the Employer of Record should provide customized advice and support. Their role is to help you navigate the termination process in a positive and legal manner. This requires their availability, willingness to assist during difficult times, and knowledge of local regulations. Ensuring that ending an employment relationship is addressed in the commercial agreement you sign with the Employer of Record is vital for a strong partnership.

It is important to inquire if the Employer of Record has established procedures for compliantly ending employment agreements. Ideally, they should require their customers to notify them at the first indication of a potential termination. This proactive approach allows for the proper procedure to be followed from the beginning, helping to avoid any potential employment tribunal or labor court cases.

At Foothold America, we understand the importance of providing comprehensive support when it comes to terminating an employment agreement. Our team is committed to offering customized advice and assistance, helping you navigate the termination process in a positive and legal manner. Our availability and willingness to support you during difficult times, coupled with our extensive knowledge of local regulations, ensure a smooth and compliant transition. With Foothold America as your Employer of Record, you can trust that your termination processes will be handled with professionalism and expertise.

7. What level of responsiveness can you expect from the Employer of Record once you become their customer?

While much of the work with an Employer of Record is established at the beginning of the relationship, there may be situations that arise during your partnership where you require their support. Employment processes can be complex, and it is important that the Employer of Record ensures a seamless experience for all involved parties.

Even if a modern Employer of Record organization has implemented software development best practices, streamlined workflows, and automation, human support should still be readily available when needed. It is essential to understand how their support system operates. Can they demonstrate expertise in payroll and HR from the initial interaction? How reliable are they? What is their track record in helping customers? Understanding their support workflow can help manage expectations regarding issue resolution time and save you valuable time. It should not feel like you are being passed from one representative to another.

Further, it is crucial to understand how they handle emergency situations, both in the short and long term. For instance, if an employee in another country experiences a medical emergency and requires access to their insurance, will the Employer of Record be available via phone, email, or online chat to provide assistance? Additionally, if an employee needs to relocate to another country, how efficiently can the Employer of Record facilitate this transfer?

The key here is to ascertain how the Employer of Record manages your expectations regarding their availability and whether the associated costs are clear and transparent.

At Foothold America, we pride ourselves on responsiveness and support we offer to our clients. We emphasize the importance of human support and whilst we recognize that employment processes can be complex, our knowledgeable team of local experts is dedicated to ensuring a seamless experience for all parties involved.

8. How is the management of payroll data handled, and what level of oversight do you have?

Tax bands, credits, allowances, benefits-in-kind, supplements, and updates to tax codes are just some of the many considerations that must be taken into account. When working with an Employer of Record, the management of employee data and ensuring its security, while maintaining an efficient workflow, can become increasingly complex. While your payroll department may have their own auditing procedures, by entrusting this responsibility to an Employer of Record, you are effectively placing yourself in their hands.

It is crucial to understand the data change workflow utilized by the Employer of Record and the level of transparency you have in this process. Is there a single product solution available to both you and your workers, or is a combination of tools such as email, spreadsheets, and cloud storage utilized? An interface can significantly improve your ability to review and audit final payroll costs, helping to decrease the likelihood of errors.

At Foothold America, we understand the importance of efficiently and securely managing payroll data. By entrusting your payroll management to Foothold America, you are placing yourself in the hands of experts who have a deep understanding of US employment law and regulations. We prioritize the security and efficiency of your payroll data, providing you with the confidence that your employees’ information is in safe hands. Our state-specific knowledge further ensures that your payroll is compliant with local regulations and requirements.

9. What are the costs associated with employing someone through the Employer of Record?

When partnering with an Employer of Record to employ someone, understanding the cost structure is essential. Typically, an Employer of Record will charge a flat fee for their service, regardless of the salary they are handling, or a set percentage of the compensation. These fees may be standardized across countries or slightly vary. They are typically billed monthly or annually. The specific price quoted may depend on factors such as the time commitment, the number of workers, and other considerations.

It is important to inquire about the fee structure in detail and request assistance with gross-to-net calculations, including employer taxes and the Employer of Record’s fee. This will allow you to have a clear understanding of the total cost of employing someone through their services, both on a monthly and annual basis.

Additionally, clarify whether the quoted fee covers all the services provided by the Employer of Record or if there may be additional charges. For example, ask if there are extra fees for specific circumstances such as employment termination. You should also consider how the fee structure may impact employment in multiple countries if applicable. Finally, it is crucial to understand any potential liability for fees should you decide to terminate the contract before its agreed-upon duration.

At Foothold America, we believe in providing transparent and straightforward pricing for our Employer of Record services. We aim to make the process as simple as possible for you. That’s why we have no onboarding fee, no offboarding fee, and no payroll fee, no deposits and offer a competitive monthly fees. We understand the importance of cost certainty when expanding into the US market, and our pricing structure reflects our commitment to providing value and support to our clients.

10. What are the key terms and conditions of the commercial agreement with the Employer of Record, and how easy is it to terminate the relationship?

When working with an Employer of Record, it is crucial to understand the terms and conditions of the commercial agreement. Beyond explicitly outlining the handling of employee terminations, there are other important terms that you should consider. These may include the minimum term of engagement, upfront deposits, minimum team size, expectations for adding new workers, cancellation clauses and fees, and the ease of extracting employer or employee data from their systems.

It is also critical to clarify the division of responsibilities and ownership of compliant employment, as well as any terms related to IP ownership and confidentiality, onboarding fees, payment transfer fees, foreign exchange fees, and support fees. You should also inquire about any fees associated with customizing employment agreements or later addendums.

If you are unhappy with your Employer of Record, it is essential to understand the terms under which you can terminate the relationship. This may include any obligations to work with them for a set period and the potential associated fees. However, it is common sense that no Employer of Record should make it overly difficult to move to another provider or to move to employing people through your own entities.

At Foothold America, we understand the importance of clarity and transparency in our commercial agreements. When partnering with us as your Employer of Record, we strive to ensure that all terms and conditions are clearly outlined for your peace of mind, and we always ensure that it is easy to end the relationship if necessary. With our EoR service, you can enter and exit the United States market as you wish without a long-term commitment. We believe that no Employer of Record should make it overly difficult for you to move on to another provider or to transition to employing people through their own entities. Our clients’ satisfaction and success are our top priorities.

Begin your journey towards US employment with confidence today!

We trust that the 10 questions and their significance have provided you with valuable insights on evaluating and selecting the right Employer of Record for your needs. If you’d like to learn more, our team of experienced US Expansion Advisors will be eager to address these 10 questions with you as well as answer any additional inquiries you may have.

As you navigate the complexities of global employment and international hiring, Foothold America stands out as the premier choice among the best employer of record services. Our comprehensive solution addresses all aspects of employee management and human resources, providing unparalleled support for your global operations. Whether you’re building a global team or managing remote employees, our expertise ensures smooth sailing through the intricacies of international employment laws and regulations. At Foothold America, we don’t just offer a service; we provide a partnership that empowers your global ambitions. Our deep understanding of the U.S. market, combined with our agile approach to global employment solutions, positions us uniquely to help you achieve your expansion goals. By choosing Foothold America, you’re not just hiring an employer of record – you’re gaining a dedicated ally committed to your success in the dynamic landscape of international business. Let us handle the complexities of global employment, so you can focus on what you do best: growing your business on the world stage.

RESOURCES

FAQ’s

Get answers to all your questions and take the first step towards a US business expansion.

Unlike global Employer of Record providers, Remote, Papaya Global, Oyster HR, G-P, and PGC, we specialize exclusively in the US market, offering deeper expertise and focused solutions for international companies expanding specifically to America. Our specialized knowledge ensures better compliance and support.

The best EOR for a company is determined by several factors, including: local labor law expertise, global reach, ease of use, comprehensive services, risk management, and tax compliance.

EOR services benefit companies of all sizes and industries that operate globally. However, they are particularly advantageous for small and medium-sized enterprises looking to expand into new markets without the complexities of setting up foreign entities.

When using an EOR, the employees are legally employed by the EOR, while the client company retains control over their work. This eliminates the need for the client to establish a legal entity in the employee’s location.

A good EOR can streamline global workforce management by handling payroll processing, benefits administration, tax compliance, and employee onboarding. This allows companies to focus on their core business and reduce administrative burdens.

While the initial costs of using an EOR may be higher, the long-term savings can be significant. EORs often have established relationships with local vendors and can negotiate better rates for services like payroll and benefits. Additionally, they can help mitigate risks associated with operating in foreign markets.

An employer of record platform streamlines the process of hiring international employees by handling legal compliance, payroll, and HR services in different countries. This allows companies to access global talent pools without the need to establish separate entities in each location, making talent acquisition more efficient and cost-effective.

Yes, many employer of record services offer solutions for managing both full-time international employees and independent contractors. They can help ensure compliance with local labor laws, handle payroll services, and manage HR processes for various types of workers across different countries.

Employer of record platforms provide essential support for remote teams by managing payroll, benefits, and compliance across multiple jurisdictions. They often offer digital tools for onboarding, time tracking, and performance management, which are crucial for effectively managing distributed workforces.

An employer of record takes on the responsibility of managing global payroll, ensuring accurate and timely payments while complying with local tax regulations. This includes calculating wages, deductions, and benefits according to the laws of each country where employees are located, significantly reducing the complexity of running a global payroll.

Employer of record services act as partners, enabling companies to quickly establish a presence in new markets without the need for extensive legal and administrative setups. By handling international employment logistics, these services allow businesses to focus on their core operations and growth strategies, facilitating smoother and faster global expansion.