How to Register a Company in the USA: A Step-by-Step Guide

Starting a business in the USA is a great opportunity for entrepreneurs worldwide as the country provides an excellent platform for growth and innovation. Registering a company in the USA is a significant step in the right direction as it enables entrepreneurs to gain access to funding, grants, and opportunities that would otherwise not be available.

–

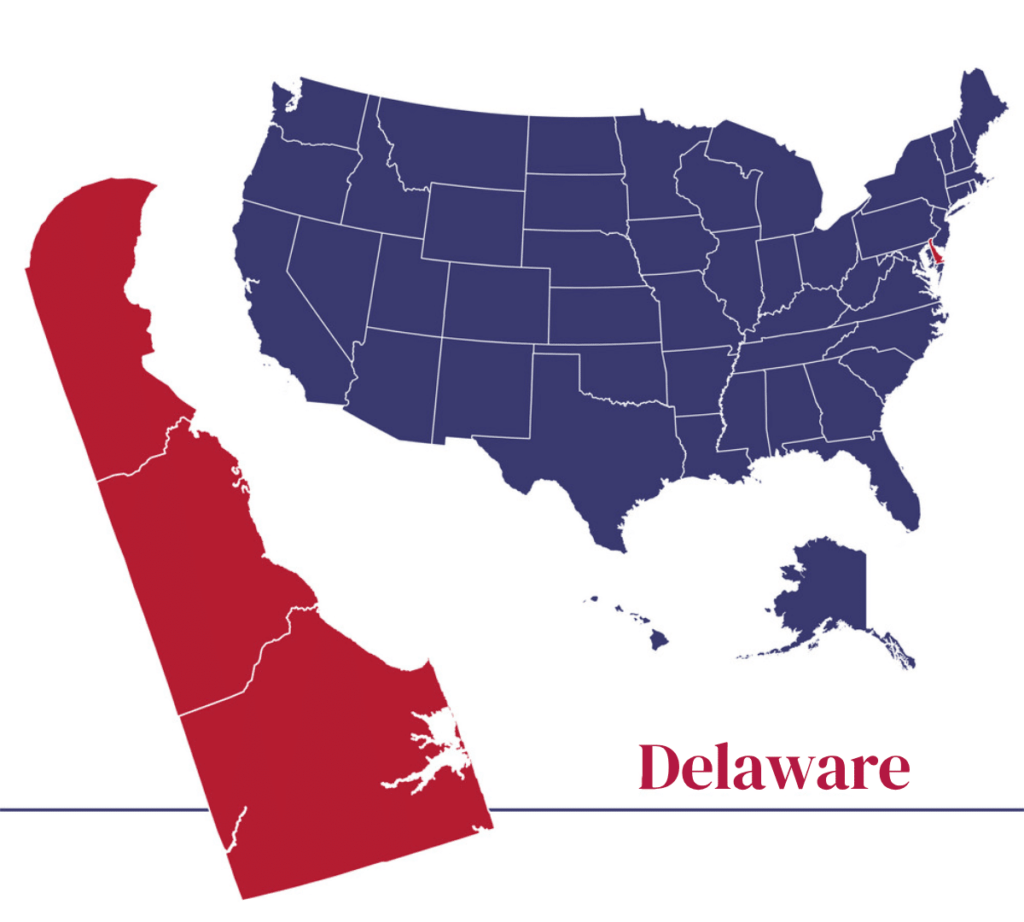

One important consideration for businesses looking to set up an entity in the USA is choosing the state in which to register. This decision can have significant implications for taxes, regulations, and other factors that can affect your business operations. In this article, we will explore the different state options available to businesses and the key considerations to keep in mind when selecting a state for your business entity registration. It’s important to remember that when expanding your business to the United States, incorporating in Delaware is often the preferred choice due to its business-friendly laws and tax benefits. However, the location of your office or headquarters can be in any US state, providing you with flexibility to choose the best location for your business needs.

Additionally, we will outline the benefits of setting up a US entity, provide an overview of the entity types available, and discuss the process of registering your company. We will also address compliance and ongoing requirements and additional considerations that you should be aware of before registering your company in the USA.

Importance of Registering a Company in the USA

When it comes to expanding your business into the USA, registering your company is a crucial step that should not be overlooked. Not only does it provide you with a solid legal foundation, but it also offers a multitude of benefits that can greatly impact your success in the market.

There are several reasons why businesses, including non-US companies, may need to incorporate in the USA. Firstly, some big US clients will only do business with American companies. Therefore, non-US companies may find it necessary to incorporate in order to access these clients and secure business opportunities.

Additionally, if companies want to send one of their senior leadership team (SLT) members to build a business in the US, they will need to have their US subsidiary sponsor the immigration application. In such cases, registering a company in the USA becomes vital to facilitate the immigration process and ensure that the SLT member can legally reside and work in the US.

Registering your company in the USA grants you access to funding opportunities and government grants that are specifically available to US businesses. This can be a game-changer when it comes to securing the necessary resources to grow and thrive in the American market.

Furthermore, registering your company establishes credibility and trust with potential customers and partners. It demonstrates your commitment to operating within the local regulatory framework and showcases your seriousness as a business entity. This can open doors to partnerships, collaborations, and new opportunities that would otherwise be inaccessible.

Additionally, registering your company provides non-US companies with the added benefit of separating their US business from their home country. This separation helps protect their home country from the risks associated with doing business in the US, particularly in the litigious climate that exists there. By establishing a separate legal entity in the US, non-US companies can limit their liability and shield their home country assets from potential legal disputes or financial challenges that may arise in the US market. This ensures that any issues or liabilities that arise in the US business will be contained within the US entity, providing an added layer of protection for the parent company.

.

In summary, registering your company in the USA is vital for unlocking opportunities, establishing credibility, and protecting yourself legally. By partnering with Foothold America, you can navigate the registration process with confidence, ensuring compliance and positioning your company for success in the US market.

Key Benefits of Registering a Company in the USA

Disclaimer: Please note that the availability of funding opportunities, tax regulations, and other factors discussed in this guide may vary depending on the state in which your company is registered. It is important to understand that funding programs, tax incentives, and regulations can differ significantly from one state to another in the USA. The information provided in this guide is intended to provide a general overview and should not be considered as legal, financial, or tax advice.

Access to funding and grants that are exclusively available to US businesses, providing a significant boost to your financial resources.

✔️Access to funding and grants

Access to funding and grants that are exclusively available to US businesses, providing a significant boost to your financial resources.

✔️ Personal liability protection

Personal liability protection, separating your personal assets from your business liabilities, providing peace of mind and minimizing legal risks.

✔️ Establishment of business credibility

Establishment of credibility and trust with potential customers, investors, and partners, positioning your business as a reliable and trustworthy player in the market.

✔️ Tax advantages

Tax advantages, including a range of deductions and incentives provided by the US government that can significantly reduce your tax liabilities.

✔️ Better access to markets and customers

Expanding your business in the USA provides better access to a vast market and a wider customer base, creating opportunities for growth and increased revenue potential.

✔️ Flexibility in choosing the business entity

Flexibility in choosing the most appropriate business entity that aligns with your business strategy, offering the opportunity to optimize your business operations and structure.

–

At Foothold America, we provide expert guidance in navigating the complexities of US employment law and regulations, ensuring full compliance and mitigating risks associated with registering your company in the USA. Our state-specific knowledge and comprehensive benefits packages offer real value to our clients, positioning us as a trusted partner in their US expansion endeavours.

Choosing the Right Business Entity

When expanding your business into the US, one of the decisions you’ll need to make is choosing the right US business entity. The entity you select will determine how your business operates, what taxes you pay, and your personal liability protection. It’s a crucial decision that requires careful consideration and expert guidance.

There are several options available, including sole proprietorships, partnerships, corporations, and limited liability companies (LLCs). Each has its own advantages and disadvantages, and the choice that’s right for your business will depend on factors such as the size of your organization, the level of personal liability protection you require, and the tax implications.

At Foothold America, we work with our clients to understand their unique needs and goals and guide them through the process of choosing the best business entity for their US operations. Our state-specific knowledge and comprehensive benefits packages offer real value to our clients, positioning us as a trusted partner in their US expansion endeavors. Partnering with us ensures that you’ll have the expertise and support you need to choose the right business entity and establish a solid foundation for sustained growth and success.

What are the types of Business Entities in the USA?

The most common business entities in the USA include:

- C-Corporation (C-Corp)

- Limited Liability Company (LLC)

- S Corporation (S-Corp)

Choosing the right entity depends on factors such as the size of your business, the level of personal liability protection desired, and tax implications.

Pros and Cons of Each Entity Type in the USA

When expanding your business into the USA, it’s crucial to understand the pros and cons of different entity types. As mentioned above, the three common choices are limited liability companies (LLCs), S corporations (S-corps), and C corporations (C-corps). Each has its own advantages and considerations that can impact your business.

Opening a C-Corp in the USA

Opening a C-Corporation (C-Corp) in the USA can have both advantages and disadvantages for non-US businesses. Here are some key points to consider:

What are the advantages of Opening a C-Corp in the USA?

Access to Capital: C-corps have the ability to raise capital by selling shares of stock to an unlimited number of shareholders. This can be beneficial for non-US businesses looking for investment opportunities and funding for growth.

Limited Liability Protection: One of the main advantages of a C-Corp is limited liability protection. This means that the owners’ personal assets are generally protected from the debts and liabilities of the company. Non-US businesses can benefit from this protection and minimize personal risk when operating in the US market.

What are the disadvantages of Opening a C-Corp in the USA?

Complex Governance and Compliance: C-corps have a more formal structure and are subject to stricter governance requirements and compliance regulations compared to other business entities. Non-US businesses will need to ensure they are familiar with and can comply with these obligations, which may involve additional administrative and legal costs.

Opening an LLC in the USA

The LLC structure was primarily designed for US citizens to optimize their tax efficiency, making it uncommon for non-US companies to be advised to open an LLC. However, non-US companies operating as LLCs can benefit from simplified tax reporting through pass-through taxation, flexibility in management structures, and reduced regulatory requirements. It is important to note that attracting investors or raising capital may pose challenges, as investors often prefer traditional corporations. It is not recommended for non-US businesses to open an LLC.

Opening an S Corp in the USA

When expanding to the USA, Non-US companies should be aware that foreign-owned entities are not eligible to open an S Corporation in the country. S Corporations are limited to being owned by US citizens or resident aliens, making them unavailable for non-US entities.

It is important for non-US businesses to carefully evaluate the advantages and disadvantages of opening a C Corp in the USA based on their specific circumstances and goals. Consulting with legal and tax professionals familiar with US business laws and regulations can provide valuable guidance in making informed decisions.

Factors to Consider When Choosing the Right Entity

When non-US businesses are expanding into the USA, choosing the right entity is a critical decision that can greatly impact their operations and legal structure. Several factors should be considered when making this choice to ensure it aligns with the business’s goals, legal requirements, and tax implications. The following are key factors that non-US businesses should consider when selecting the right entity in the USA.

1. Liability Protection

One of the primary concerns for any business is protecting personal assets from business risks. Limited liability entities such as Limited Liability Companies (LLCs) and Corporations (C-corps) offer legal protection, separating personal assets from business liabilities. Non-US businesses should carefully assess the level of liability protection needed and choose an entity that provides adequate safeguards.

2. Tax Implications

Tax implications are a crucial factor for non-US companies to consider when choosing the right entity for their operations in the USA. Different business structures have varying tax obligations and considerations. Seeking the guidance of tax advisors or experts in international tax law can help navigate these complexities and make informed choices regarding entity selection. At Foothold America, we work with tax partners to provide specific advice for companies looking to expand to the USA.

3. Management and Governance Structure

Different entities have varying management and governance structures. C-corps have a more formal structure with a board of directors, officers, and shareholders. LLCs generally offer flexibility in management and decision-making. Non-US businesses should consider their management preferences and the level of flexibility required in day-to-day operations.

5. Compliance Obligations

Each entity is subject to specific compliance obligations and reporting requirements. For example, C-corps have more complex governance and compliance requirements than LLCs. Non-US businesses should understand these obligations to ensure they can fulfill them, taking into account any additional administrative and financial costs associated with compliance.

6. Funding and Investment Opportunities

If non-US businesses plan to raise capital or attract investment in the US market, they should consider the entity’s ability to do so. C-corps can issue different classes of stock, making them suitable for attracting investors. LLCs, on the other hand, offer flexibility in profit-sharing and ownership structure. Non-US businesses should evaluate their funding and investment goals to select an entity that aligns with their objectives.

7. Future Growth and Expansion

Consideration should be given to the future growth and expansion plans of the business. Different entities may have different limitations or advantages when it comes to expanding operations or seeking opportunities in new states or markets. Non-US businesses should choose an entity that allows for flexibility and scalability to accommodate their future growth plans.

Choosing the right entity is vital for success in the US market, and Foothold America is ready to help clients make informed decisions that ensure compliance and maximize profitability.

Popular States for Company Registration in the USA

Disclaimer: Foothold America recommends registering a US entity in Delaware and does not endorse or recommend registering in any other US states. The recommendation is based on various factors such as favorable laws, business-friendly regulations, and well-established legal and judicial systems in Delaware. However, each business has unique requirements and circumstances. It is essential to seek professional advice and conduct thorough research before making a decision on entity registration in any specific US state. Foothold America cannot be held responsible for any consequences or decisions made based on this recommendation.

Expanding to the USA involves considering different drivers. When choosing a state for incorporation, Delaware is often recommended for several reasons. Delaware offers favorable laws and business-friendly regulations, providing a conducive environment for companies. Delaware has a well-established legal and judicial system, ensuring stability and predictability. Keep reading to find out more about why Delaware is the most popular incorporation location amongst non-US companies.

On the other hand, the decision to set up an office or establish a physical presence in the US is driven by different criteria. Factors like the availability of talent, proximity to clients and prospects, transportation links, time zone considerations, sector specializations, and growth potential come into play. These considerations aim to optimize operations, facilitate client interactions, and strategically position the business for success in the US market.

DE: Delaware

Delaware (DE) is a popular state for company incorporation due to its favorable business climate and extensive benefits. Delaware offers a flexible and modern corporate laws environment and no corporate income tax for businesses that operate outside the state, providing businesses with greater flexibility in terms of corporate structure and governance. Additionally, Delaware offers privacy protection for business owners and has a dedicated court system that specializes in corporate law matters. Delaware is a preferred business location for many non-US businesses. Read more about incorporating your company in Delaware.

FOOTHOLD AMERICA

NY: New York

New York (NY) has long been a hub of world commerce and finance, making it a popular destination for entrepreneurs seeking global exposure. New York boasts a diverse range of industries, including finance, healthcare, technology, and manufacturing, and has access to a highly skilled workforce.

CA: California

California (CA) is renowned for its innovation and technology sectors, with Silicon Valley serving as a magnet for tech startups and giants. California’s diverse economy, including industries such as entertainment and tourism, make it a perfect choice for entrepreneurs who want to tap into a vast market with enormous growth potential.

TX: Texas

Texas (TX) is an ideal place for entrepreneurs seeking a favorable tax climate and abundant resources. Texas has become a hub for energy, technology, and healthcare industries and is also known for its low-cost labor and business-friendly laws.

NC: North Carolina

North Carolina (NC) has a robust economy, especially in finance, technology, and manufacturing. It boasts a skilled workforce and offers access to some of the country’s finest research universities, giving entrepreneurs access to a vast pool of talent.

MA: Massachusetts

Massachusetts (MA) is a vital hub for higher education and research institutions; it attracts entrepreneurs in biotech, healthcare, and finance industries. Massachusetts’ proximity to major financial and educational players like New York and the Boston-based Ivy League institutions makes it an attractive choice for non-US entrepreneurs.

FL: Florida

Florida (FL) is popular among entrepreneurs for its favorable business environment. It has no personal income tax, and its vibrant tourism industry offers opportunities in hospitality and entertainment. Florida is also home to various airports and seaports, which makes it easy to access foreign markets. Read more about registering your company in Florida.

AZ: Arizona

Arizona (AZ) is a state with a pro-business environment, low taxes, and a strong focus on technology and manufacturing. Although it’s relatively small in terms of population, Arizona offers entrepreneurs a growing market to tap into with a rapidly growing corporate landscape.

PA: Pennsylvania

Pennsylvania (PA) has a diverse economy, with strong bases in healthcare, energy, and manufacturing. Pennsylvania boasts top-ranked universities and colleges and is located strategically to major metropolitan areas making it attractive for entrepreneurs looking to break into the American market.

NJ: New Jersey

New Jersey (NJ) is located near major markets, making it an ideal choice for access to customers and resources. The state’s extensive transportation network provides easy access to New York City and Philadelphia, offering critical advantages for entrepreneurs looking to expand the reach of their business.

How to set up a US Subsidiary

An important consideration for foreign companies wishing to do business in the USA is whether and when to form a US entity. In this eBook, discover when and why businesses should consider setting up a US entity.

How to Register a Business in the USA [Step-by-Step Process]

The process of registering a company varies from state to state, but the key steps include:

1. Choose the Business Structure

Determine the legal structure of your business, such as a sole proprietorship, partnership, LLC, or corporation. Each structure has different implications for taxation, liability, and management.

2. Choose the State of Incorporation

Select the state where you want to incorporate your business. Consider factors such as business-friendly regulations, tax advantages, and proximity to your target market.

3. Name Your Business

Choose a unique and distinctive name for your business that complies with state naming requirements. Conduct a name search to ensure the company name you want is not already in use.

4. Register Your Business Name

Register your business name with the appropriate state authority, which is usually the Secretary of State’s office. This process establishes your legal right to use the name.

5. Obtain an Employer Identification Number (EIN)

Apply for an EIN from the Internal Revenue Service (IRS). This unique identification number is necessary for tax purposes and is often required when opening a business bank account.

6. Register for Trademarks, Patents, or Copyrights

If applicable, protect your intellectual property by registering trademarks, patents, or copyrights with the appropriate government agencies.

7. Open a Business Bank Account

Separate your personal finances from your business finances by opening a business bank account. This helps with tracking income and expenses and simplifies tax filings.

8. Comply with Ongoing Reporting and Compliance

Stay compliant by fulfilling ongoing reporting and compliance requirements, such as filing annual reports, renewing licenses, and meeting tax deadlines.

–

It’s important to note that the specific steps and requirements may vary slightly depending on the state and business structure you choose. It’s advisable to consult with an attorney or business advisor familiar with US regulations to ensure a smooth registration process.

Compliance and Ongoing Requirements in the USA for Foreign-Owned Businesses

Expanding into the USA can bring great opportunities for non-US businesses. However, it also comes with various compliance regulations that must be followed to ensure legal and ethical business practices. Both federal and state-level regulations, industry-specific requirements, and enforcement agencies such as the United States Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) influence the compliance landscape. It is crucial for non-US businesses to understand and adhere to these requirements to operate successfully in the US market.

👌 Annual Reports and Filing Obligations

Non-US businesses may be required to file annual reports or biennial statements depending on the state they operate in. These reports help maintain accurate records and provide important information to state authorities regarding the business’s operations and financial status.

👌 State and Federal Tax Obligations

Complying with tax obligations is essential for non-US businesses. This includes filing tax returns, paying income taxes, payroll taxes, sales taxes, and any other applicable taxes. Understanding the tax regulations at the federal, state, and local levels is crucial to avoid penalties and maintain compliance.

👌 Licensing and Permits

Depending on the nature of the business, non-US businesses may need to obtain specific licenses and permits to operate legally in the USA. These requirements can vary by state and industry, so thorough research is necessary to identify and comply with the specific licensing and permit requirements.

👌 Employment Law Compliance

Non-US businesses expanding into the USA must comply with federal and state employment laws. This includes adhering to regulations related to minimum wage, overtime pay, workplace safety, anti-discrimination, and harassment policies. Complying with these laws ensures fair and ethical treatment of employees.

👌 Intellectual Property Protection

Non-US businesses should protect their intellectual property through trademarks, patents, or copyrights. Registering and maintaining these protections can help safeguard the company’s unique products, services, or branding and ensure they are not infringed upon.

👌 Data Privacy Regulations

With increasing concerns over data breaches and consumer privacy, non-US businesses must comply with data protection regulations such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) if they handle personal data. Understanding and adhering to these regulations is crucial to protect customer data and avoid legal consequences.

👌 Corporate Governance

Maintaining good corporate governance practices is important for non-US businesses operating in the USA. This involves establishing sound internal controls, conducting regular audits, and maintaining accurate financial records. Adhering to corporate governance principles helps build trust and credibility with stakeholders.

–

Compliance with ongoing requirements in the USA is essential for non-US businesses to mitigate legal and reputational risks. Staying informed about changes in regulations and seeking legal advice if needed helps ensure ongoing compliance and business success in the US market.

Let Foothold America do the hard work for you!

When it comes to expanding your business into the United States, the registration and compliance process can be complex. That’s where our team of US expansion advisors at Foothold America comes in. We offer bespoke and tailored advice to help you navigate the intricacies of entering the US market successfully. We take the time to have a discovery call with you to understand your specific needs and goals. Based on your unique circumstances, our US Expansion Advisors will provide customized guidance on your US business expansion.

In addition to helping you set up a US business entity, we also provide comprehensive support in navigating employment and benefits packages. If you are looking to hire employees in the US, we can assist you in creating competitive and attractive employment packages that comply with federal and state regulations. We understand the importance of offering a well-rounded compensation and benefits package to attract top talent and ensure your employees are taken care of. To find out more, please click here.

Partnering with our US expansion advisors ensures that your business is set up for success in the US market. By taking advantage of our expertise, you can confidently navigate the complexities of establishing your business in the United States and focus on your growth and expansion goals. Contact us to schedule a discovery call today to receive personalized guidance tailored to your specific business needs.

Please note that this information is provided for general informational purposes and does not constitute legal advice. Consulting with legal professionals is recommended for specific compliance matters. As your trusted partner, Foothold America is here to support you every step of the way in your US expansion endeavors.

FAQ’s

Get answers to all your questions and take the first step towards registering your business in the USA.

Yes, non-residents can register a US entity. However, there may be additional requirements and considerations for non-resident business owners. It is essential to understand the specific regulations and seek expert guidance to navigate the process successfully. Contact us today to find out more.

The time it takes to register a new company in the USA can vary depending on several factors, including the type of business entity you are forming and the state in which you are registering. In general, the process can take anywhere from a few days to several weeks or even months. Some states have expedited processing options that allow for faster registration, while others may have longer processing times due to a high volume of filings. Additionally, the complexity of your company structure and any required documentation or approvals can also affect the timeline. It is recommended to consult with a legal professional or business formation service to ensure that you understand the specific requirements and estimated timeframes for registering your new company in the USA.

The documents required for US company registration can vary depending on the type of business entity you are forming and the state in which you are registering. However, some common documents that may be required include:

1. Articles of Incorporation or Articles of Organization: This document outlines the basic details of your company, such as its legal name, purpose, and registered agent.

2. Operating Agreement or Bylaws: This document sets out the internal rules and regulations for your company, including how it will be managed and how decisions will be made.

3. Employer Identification Number (EIN): You will need to obtain an EIN from the Internal Revenue Service (IRS) if you plan to have employees or if your business entity requires one for tax purposes. For more information about EIN and IRS, click here.

- Employer Identification Number (EIN) . This is a tax identification number that ensures your business is set up to pay taxes, benefit from any deductibles, hire employees, and run other operations.

4. Business Licenses and Permits: Depending on your industry and location, you may need to obtain specific licenses or permits to legally operate your business.

5. Registered Agent Information: A registered agent is a person or entity designated to receive legal and official documents on behalf of your company. You will need to provide their contact information during the registration process.

It is important to consult with a legal professional or business advisor for specific guidance on the documents required for registering a company in the United States, as requirements can vary by state and business type.

Registering a US entity can provide several benefits, including limited liability protection, credibility with customers and partners, access to US markets, and potential tax advantages. By having a registered US entity, you can establish a formal presence, build trust, and access the numerous opportunities available in the US business landscape.

Generally, setting up a US subsidiary does require some form of physical presence, such as a registered office or a designated agent in the United States. This presence is necessary for legal and administrative purposes. However, it doesn’t mean that you need to open a full-fledged office or have employees on the ground. You may explore options such as virtual offices or co-working spaces to meet the initial requirement.

Foreigners can start by choosing their type of company and registering with state agencies. You’ll need a business registration number, social security number or ITIN, and approval from local authorities. The small business administration offers guidance for international entrepreneurs.

Register with state-level authorities, obtain federal government approval, set up a business account, and secure necessary permits from local governments. The process varies for small businesses versus large businesses, depending on your business activities.

Requirements include selecting a business structure (incorporated vs unincorporated businesses), obtaining permits from local authorities, establishing a brand identity, and meeting state agencies’ compliance standards. Unregistered business operations are not permitted.

Delaware offers advantages for both small businesses and large businesses, including flexible business registration processes, strong privacy laws, specialized courts, and tax benefits. Many state-level regulations are more favorable than other locations. Read more about the benefits of incorporating your business in Delaware here.

Registration timeline varies by state agencies and type of company, typically taking 2-6 weeks. The process includes federal government approval, state-level registration, and setting up a business account.

Costs vary by state-level requirements and business activities. Expect to pay for business registration fees, local authorities permits, brand identity protection, and initial business account setup. The small business administration offers cost guidance.

Yes, all business registration requires a physical U.S. address for local governments and federal government correspondence. Unregistered business operations aren’t permitted. Contact Foothold America for more information.

Tax obligations vary by state-level locations and activities. Both incorporated and unincorporated businesses must register with the federal government and local authorities. Consider state agencies’ requirements and small business administration guidelines.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.