Why European Founders Should Enter American Markets Now

January 20th, 2025, marked the inauguration of Donald Trump as the President of the United States. This political shift brings potential implications for international business founders considering expansion into the US market. Analyzing recent economic indicators, including GDP growth and inflation rates, can provide valuable insights for strategic decision-making.

UK and European founders must ask themselves, “Is it time to go to the United States?”

We believe the answer for many businesses is a resounding “Yes!” and here’s why.

US Economic Performance vs. European Counterparts

In 2023, the United States exhibited robust economic growth, with its GDP increasing by 2.5% up from 1,9% in 2022. In contrast, the Eurozone experienced a significant slowdown, with GDP growth decelerating to 0.5% from 3.4% in 2022. This divergence highlights the relative strength of the US economy compared to its European counterparts.

In the second quarter of 2024, the United States demonstrated robust economic performance with a GDP growth of 0.8% compared to the previous quarter. This growth underscores the resilience of the US economy during this period.

Conversely, the Eurozone exhibited more modest growth. In Q2 2024, the Eurozone’s GDP expanded by 0.2% quarter-on-quarter, indicating a slower pace than the US

In the third quarter of 2024, the Eurozone’s GDP growth improved slightly to 0.4% quarter-on-quarter, marking the most substantial growth rate in two years. This uptick suggests a gradual recovery within the Eurozone economies.

Focusing on individual European economies, Germany, the largest economy in Europe, reported a GDP of €4.18 trillion in 2023. However, Germany’s economy contracted by 0.2% in 2024, following a 0.3% decline in 2023, marking the first two-year contraction since 2003. This contraction contrasts with the rapid growth observed in the US during the same period.

Skirt the Tariffs — Be an Insider

Expanding your business to the US by establishing a US entity can be a strategic move to avoid tariffs imposed on foreign companies, particularly under policies like those threatened during the Trump administration. By registering as a domestic company, businesses can benefit from being treated as a US-based operation, which may exempt them from import duties and trade restrictions that apply to foreign firms. This can significantly reduce costs associated with importing goods and materials, making pricing more competitive in the American market. Additionally, a US entity can help streamline supply chain operations by allowing companies to source and hire locally, avoiding costly international shipping fees and customs delays.

Beyond cost savings, forming a US entity also enhances market access and credibility with American customers, investors, and partners. Many US government contracts, grants, and business opportunities are only available to domestic entities, giving companies a competitive edge. Establishing a physical presence, whether through a virtual office or an operational facility, also strengthens brand perception and fosters trust among American consumers who often prefer to engage with US-based businesses. Furthermore, a domestic structure simplifies access to US banking and payment processing services, making financial transactions smoother and reducing potential complications associated with cross-border financial operations.

Inflation Trends: Europe vs. United States

Inflation rates have been a critical concern for businesses in Europe and the United States. As of December 2024, the Euro area annual inflation rate rose to 2.9%, up from 2.4% in November. The European Union’s annual inflation rate also increased to 3.4% in December 2024, up from 3.1% in November. Notably, countries like Romania experienced higher inflation rates, recording 5% in October 2024.

In contrast, the United States has managed to maintain slightly more stable inflation rates, contributing to a more predictable economic environment for businesses with 2.7% and 2.9% rates of inflation in November and December 2024, respectively. This stability is a crucial factor for founders seeking to mitigate risks associated with high inflation, such as increased costs and pricing uncertainties.

While the inflation challenges in Europe versus the United States are not enough of a factor independently to justify US expansion, taken holistically, the US appears to be a safer bet for founders to manage the impact of inflation on their businesses.

Corporate Tax Paradise?

In 2017, President Trump advocated for a similar reduction to 15%, but the corporate tax rate was ultimately lowered to 21% from 35%. The renewed proposal reflects his ongoing commitment to decrease corporate taxes further.

President Donald Trump has proposed reducing the U.S. corporate tax rate from the current 21% to 15%. This proposal aims to incentivize companies to manufacture products domestically. However, specific details regarding the implementation timeline have not been provided.

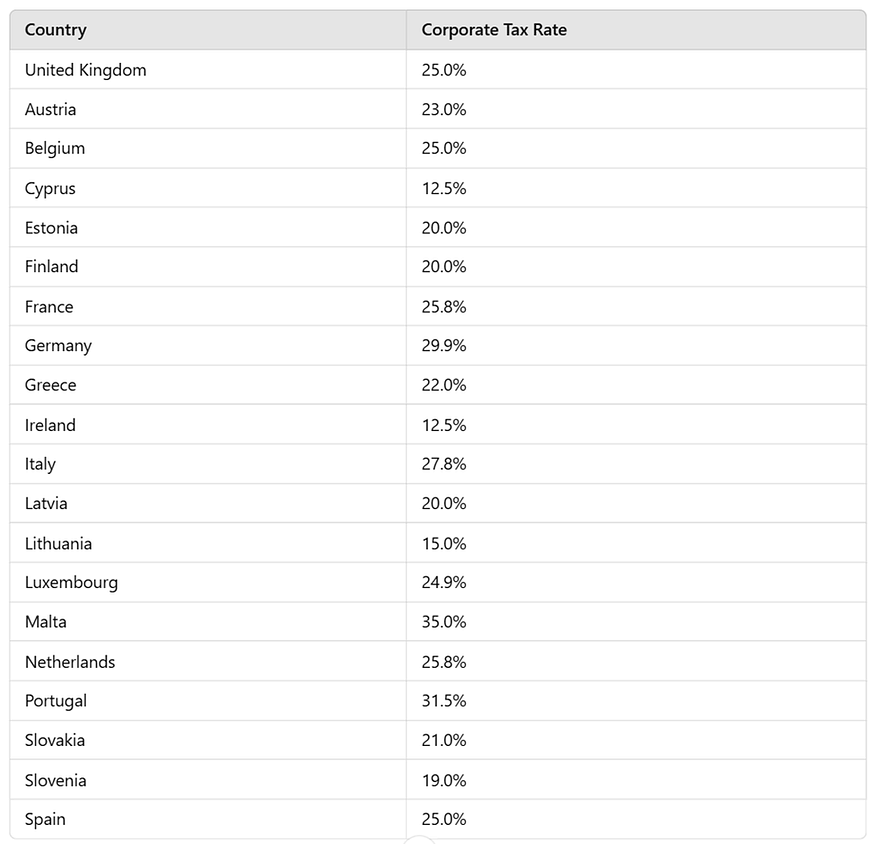

Here’s a summary of the statutory corporate income tax rates with Cyprus, Ireland, and Lithuania at or below the proposed 15% rates and only seven countries below the current US corporation tax of 21%.

Practical Tips for Bootstrapped Growth

Expanding to the US while bootstrapped requires careful resource management and strategic execution. Here are three key strategies a UK or EU company can use to make the leap.

1. Start with a Lean US Presence

Start with a lean entity structure instead of immediately setting up a full-fledged US office. Form a US C-Corp or LLC, depending on tax and operational needs, and use a virtual office in a strategic location to establish credibility. This allows you to build a US footprint cost-effectively, access US banking and payment processing, and begin with one full-time hire before committing to a US team. Leveraging Employer of Record (EOR) services can also help legally hire US employees without the complexity of setting up a US entity.

2. Target Revenue First, Then Scale Hiring

Before making major investments, focus on generating US revenue. Start with targeted sales and marketing efforts to validate demand in the American market. This can be done through strategic partnerships, online sales, or pilot programs with US customers. Once cash flow from the US market is established, reinvest profits into local hiring. A phased hiring approach — starting with sales or customer support and use outsourced service providers to ensure expensive hires directly contribute to revenue growth.

3. Leverage US Ecosystem Support

Take advantage of accelerator programs, US state incentives, and networking opportunities that support international companies entering the US. Many states offer grants, tax breaks, and business development support to foreign companies, bringing jobs and investment. Additionally, tapping into European expat founder communities and organizations like SelectUSA can provide valuable insights, connections, and soft landing resources to ease the transition.

A bootstrapped UK or EU company can effectively enter the US market and scale sustainably by keeping costs lean, prioritizing revenue, and utilizing available US resources.

Strategic Recommendations for Business Expansion

Given the current economic landscape, founders from European countries contemplating expansion into the US should consider the following.

1. Leverage US Economic Stability

The US’s consistent GDP growth and controlled inflation provide a conducive environment for business operations. Establishing a presence in the US can offer access to a large and stable consumer market, enhancing growth prospects.

2. Mitigate Risks Associated with European Inflation

High inflation rates in certain European countries can erode profit margins and increase operational costs. Expanding into the US market can be a strategic move to diversify and hedge against such economic uncertainties.

3. Capitalize on Transatlantic Economic Dynamics

The divergence in economic performance between the US and Europe presents opportunities. Businesses can benefit from favorable economic policies and a dynamic market environment in the US, especially under the new administration.

Conclusion

Through the second and third quarters of 2024, the United States demonstrated stronger economic performance than the Eurozone, as evidenced by higher GDP growth and stable inflation rates. For international business founders, these factors present a compelling case for staking your fortunes directly into the US, avoiding potential US tariffs. Businesses can strategically position themselves for success in a competitive global landscape by leveraging the economic stability and growth opportunities available.

GET IN TOUCH

Contact Us

Complete the form below, and one of our US expansion experts will get back to you shortly to book a meeting with you. During the call, we will discuss your business requirements, walk you through our services in more detail and answer any questions you might have.