Expanding your business operations to the United States can be a daunting task, especially when faced with unfamiliar employment laws and regulations. To navigate the complexities and ensure compliance, many companies turn to Employer of Record (EOR) services. In this blog, we’ll explore the concept of Employer of Record services and how they can help businesses successfully establish a presence in the US market, with the support of Foothold America.

What is an Employer of Record?

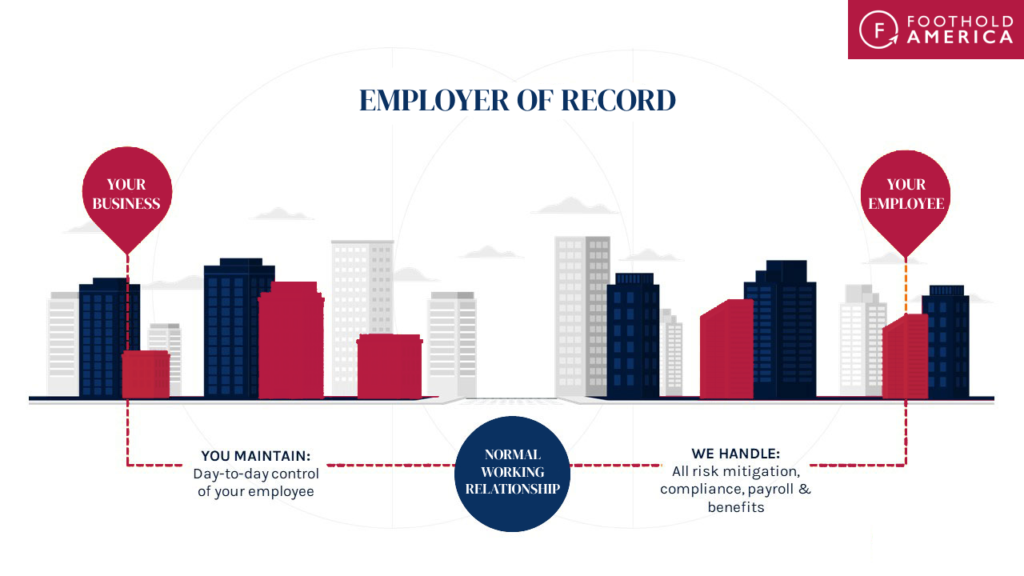

An Employer of Record (EOR) is a specialized service provider that acts as the legal employer for a business’s workforce in a foreign country. This means that the EOR handles all aspects of employment, including payroll, benefits administration, tax withholdings, and compliance with local and federal employment laws. Essentially, an EOR becomes the legal employer while the client company maintains control over day-to-day operations and management.

How does an EOR service work?

EOR services are designed to simplify the complexities of global expansion. When a company engages an EOR, it enters into an agreement where the EOR becomes the legal employer of record for the client’s employees in a specific country or region. The EOR manages all aspects of employment, ensuring compliance with local labor laws, tax regulations, and employment standards. This includes handling payroll processing, tax withholdings, benefits administration, HR management, and legal compliance.

The EOR serves as the bridge between the client and its workforce, overseeing employee contracts, statutory benefits, and mandatory registrations. The client company retains operational control and direct supervision over its employees, while the EOR handles the administrative and legal obligations associated with employing the workforce.

What does an Employer of Record do?

The primary role of an Employer of Record is to shoulder the legal and administrative responsibilities associated with employing workers in a foreign country. Some key tasks performed by an EOR include:

✔️ HR Compliance

An EOR ensures compliance with local employment laws, regulations, and labor standards. They stay up-to-date with changes in laws and offer guidance to clients to ensure compliance across various domains, such as worker classification, employment contracts, working hours, leaves, and termination procedures.

✔️ Payroll Management

EORs handle payroll processing, including calculating salaries, tax withholdings, statutory deductions, and other related tasks. They ensure accurate and timely payment of wages to employees while complying with local tax regulations.

✔️ Benefits Administration

EORs handle employee benefits programs, such as health insurance, retirement plans, and other statutory benefits required by local employment regulations. They work closely with insurance providers and local authorities to ensure compliance and facilitate benefit enrollment for employees.

✔️ Tax Compliance

EORs manage tax obligations, including filing and remitting payroll taxes, ensuring compliance with local tax regulations, and providing employees with necessary tax documents.

✔️ Legal Compliance

EORs keep up with labor laws, employment regulations, and statutory requirements applicable to the client’s specific industry. By maintaining compliance, they mitigate legal risks and minimize potential liabilities for the client.

What are the advantages of using an employer of record service?

Whether you are expanding into a new market, hiring talent, or seeking a more efficient HR solution, the benefits of utilizing an Employer of Record service are numerous and can empower businesses to thrive in a globalized economy. These benefits include:

💡 Ongoing HR support

EORs possess in-depth knowledge of local labor laws, employment regulations, and cultural practices. They provide guidance and support throughout the expansion process, ensuring compliance and reducing the risk of legal or regulatory issues.

💡 Faster Market Entry

With an EOR, businesses can establish a presence in a new country quickly, without the need to set up a legal entity. This allows companies to seize market opportunities, accelerate time-to-market, and gain a competitive edge.

💡 Onboard Talent Quickly

With their expertise in navigating the complexities of US employment law and regulations, EOR companies can expedite the onboarding process, ensuring compliance and minimizing the administrative burdens associated with hiring employees in the US. Employer of Record services further streamline the onboarding process, allowing your business to acquire top talent quickly and seamlessly.

💡 Streamlined Payroll and Benefits Administration

Managing payroll and benefits administration in the US can be time-consuming and intricate. EORs assume the responsibility of payroll processing, tax withholdings, and benefits administration, alleviating the administrative burden on businesses. Foothold America offers comprehensive benefits packages tailored to the specific needs of each client, ensuring the well-being and satisfaction of their employees.

💡 Compliance and Risk Mitigation

Navigating the complex landscape of US employment laws and regulations can be overwhelming for businesses expanding from overseas. By partnering with an EOR like Foothold America, companies can ensure compliance with federal, state, and local employment laws, reducing the risk of penalties, fines, and legal disputes.

💡 Scalability and Flexibility

EORs offer flexible workforce management solutions, allowing businesses to scale their operations without the complexities of international hiring and managing employees directly. Whether you only need to hire a few full-time employees or build an entire team, EORs offer the flexibility to scale quickly, enabling businesses to seize opportunities and adapt to market demands. With Foothold America’s state-specific knowledge and expertise, we can assist you in navigating local labor markets, handling compliance challenges and finding the right talent. You can read more about attracting talent here.

💡 Cost Savings

Engaging an EOR can lead to significant cost savings compared to setting up a legal entity or establishing a subsidiary. Businesses can avoid expenses related to legal compliance, human resources, payroll software, and benefits administration by leveraging an EOR’s infrastructure.

What are the disadvantages of using an employer of record service?

While EOR services offer numerous benefits, it’s essential to consider potential drawbacks:

❌ Limited Control over HR Processes

Since the EOR becomes the legal employer of record, the client company may have less control over HR policies and processes. Some decisions, such as termination and disciplinary actions, may require the approval of the EOR.

❌ Lack of Brand Presence

With an EOR, the employer’s brand may not be as visible or recognizable in the local market, as the EOR is considered the official employer of record. However, this can be addressed through effective communication and branding strategies.

When to Use an Employer of Record?

Employer of Record services can be an excellent solution in various scenarios, including:

👍 Remote or Virtual Teams

When hiring remote workers or establishing a virtual global team, EORs can ensure compliance with local employment laws and streamline payroll management.

👍 Market Testing

For businesses seeking to test new markets or pilot projects before establishing a legal entity, an EOR can help enter global markets quickly and efficiently.

👍 Short-term or Project-based Assignments

When engaging workers for short-term assignments or specific projects, an EOR can handle the necessary employment and compliance requirements without the need for long-term commitments.

👍 Business Expansion

EOR services are particularly beneficial for businesses planning to expand into new countries where the legal and regulatory landscape is unfamiliar. Employers of Record services provide local expertise, minimizing compliance risks.

Alternatives to using an EOR service

While Employer of Record services may be suitable in many situations, there are alternative options to consider:

❔ Setting up a Legal Entity

Establishing a local legal entity provides businesses with complete control over HR processes, compliance, and operational decision-making. However, this option involves higher costs, longer setup times, and ongoing administrative responsibilities.

❔ Joint Ventures or Partnerships

Partnering with local businesses or individuals can help navigate legal and regulatory requirements in a foreign market. Joint ventures may allow businesses to leverage local knowledge, distribution networks, and resources.

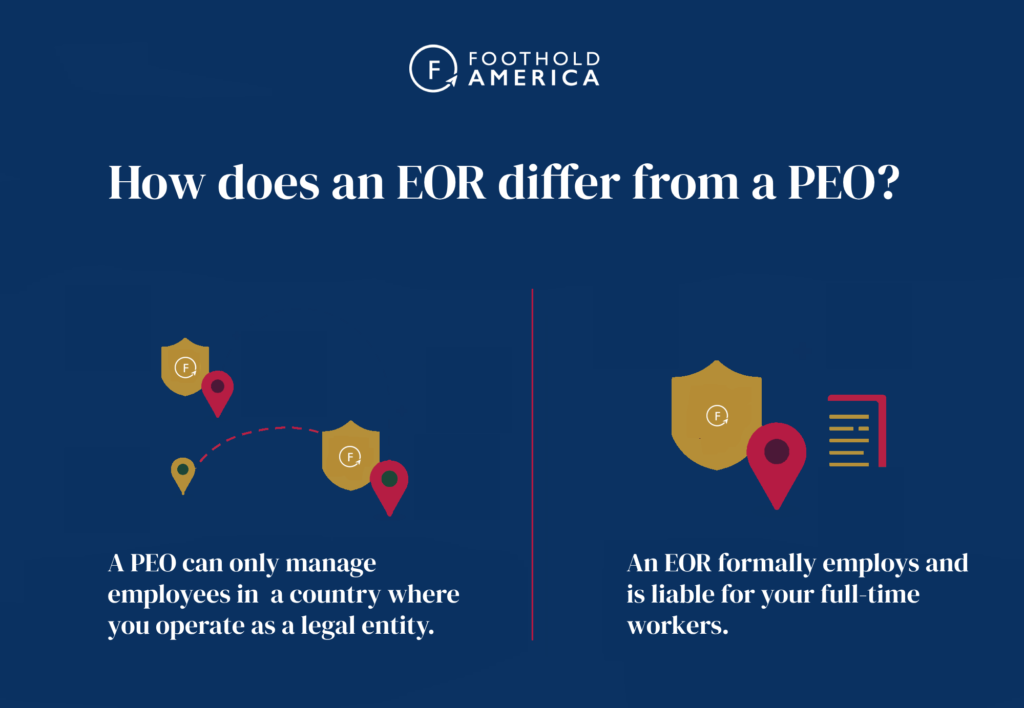

❔ Professional Employer Organizations (PEOs)

PEOs share employer responsibilities and liabilities with the client company, acting as a co-employer. PEOs handle various HR functions, including payroll compliance, benefits administration, compliance, and risk management.

❔ Freelancers and Contractors

Engaging freelancers and independent contractors can provide flexibility without the need for long-term employment commitments. However, this approach may not be suitable for businesses requiring a dedicated and integrated workforce.

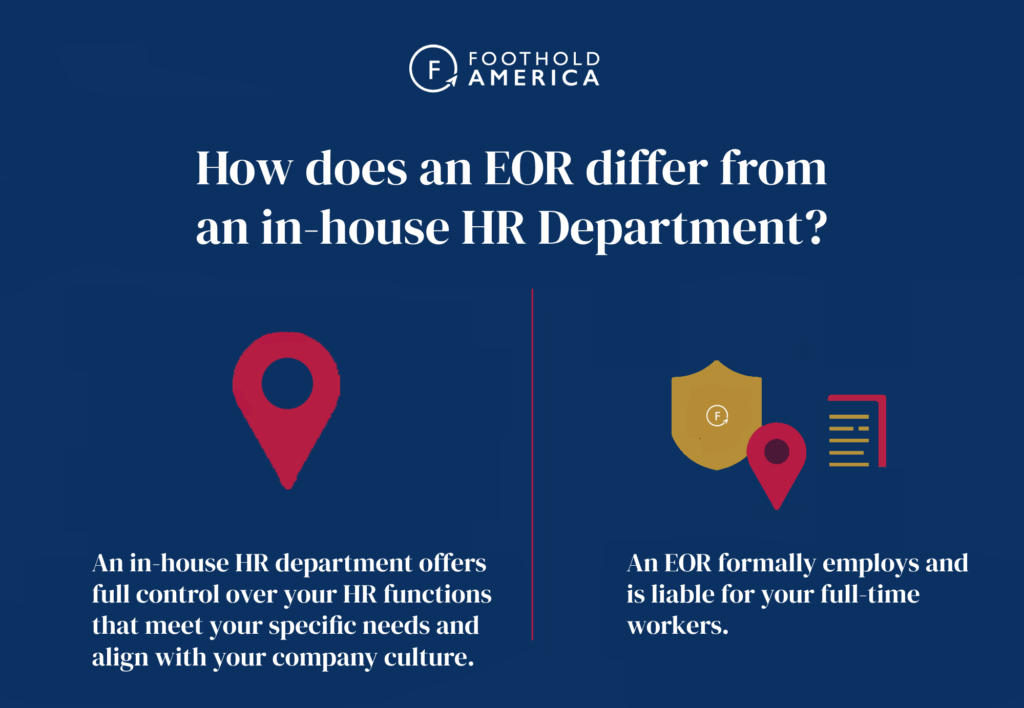

❔ In House HR Department

Having an in-house HR department allows businesses to tailor their HR policies, procedures, and practices to align with the organization’s culture and goals. This level of customization allows for greater flexibility and the ability to develop HR strategies specific to their business needs.

How does an EOR differ from a PEO?

When it comes to managing the complexities of global expansion and workforce management, businesses often face the challenge of choosing the right solution. Two popular options that come up in this context are Professional Employer Organizations (PEOs) and Employers of Record (EORs). While these terms may sound similar, they represent distinct approaches to managing your company’s human resources and employment obligations. Below, we will delve into the key differences between PEOs and EORs, helping you make an informed decision on the best solution for your business.

👌 Employment Relationship

In an EOR arrangement, the EOR becomes the legal employer of record, assuming all employment-related liabilities and responsibilities. In contrast, a PEO establishes a co-employment relationship, sharing employment responsibilities and liabilities with the client company.

👌 Control and Flexibility

With an EOR, the client maintains operational control and direct supervision over employees, while the EOR handles administrative functions. In a PEO model, the PEO holds more control over HR policies and processes, including benefits administration and risk management.

👌 Legal Structure

EORs typically establish a local legal entity in the country of operation to act as the employer of record. PEOs may utilize co-employment arrangements or establish a joint employer relationship, sharing employer responsibilities with the client company.

–

Choosing the right solution depends on your business needs, expansion goals, and the level of control you wish to maintain over HR operations. If you are looking for a global expansion solution that minimizes risk and ensures compliance, an Employer of Record might be the optimal choice. On the other hand, if you require more control over HR functions and want a domestic solution, partnering with a PEO service like our PEO+ Cross-Border Support™ could be the right fit. PEO+ acts as a co-employer with your company, assuming some HR tasks and administrative burdens while allowing you to maintain a close relationship with your US staff.

For businesses seeking a middle ground, our People Partnership Service (PPS) offers a domestic alternative to a PEO. With PPS, you retain complete control as the legal employer, but we provide comprehensive HR support to simplify your operations, including payroll processing, benefits administration, and local HR compliance.

Ultimately, consulting with experts in workforce solutions like Foothold America can help you make an informed decision and navigate the complexities of expanding your business into new territories.

Employer of Record vs US Entity Setup

When it comes to expanding your business into another country, such as the United States, there are two main options to consider: opening an entity or utilizing an Employer of Record service. Both options have their advantages and considerations, but the choice depends on your specific needs and circumstances.

Opening a local entity in another country, like the USA, can be a complex and time-consuming process. It involves navigating through various legal and regulatory requirements, such as setting up a legal entity, obtaining the necessary licenses and permits, and adhering to local laws and tax regulations. This approach gives you full control and ownership over the operations of your business in the new market. However, it also comes with significant administrative burdens and financial risks.

On the other hand, using an EOR service, like Foothold America, can provide a simpler and more streamlined path to expanding into the US market. An EOR acts as your employer representative, handling all the employment-related tasks on your behalf. This includes managing payroll, benefits administration, tax compliance, and legal and regulatory compliance. By partnering with an EOR, you can leverage their expertise and infrastructure to establish a presence in the US quickly and efficiently.

Ultimately, the choice between opening an entity and using an EOR depends on your specific circumstances, including your long-term goals, financial resources, and internal capabilities. While establishing an entity may offer greater control, it comes with higher costs and administrative burdens. On the other hand, partnering with an EOR allows for a faster and more flexible entry into the US market, with access to expert knowledge and ongoing support.

If you’d like to find out more about Foothold America’s US Entity Setup Service, please click here.

Your In-House HR Department Vs. an Employer of Record

Having an in-house HR department offers the advantage of having full control over your HR functions. You can tailor the department to meet your specific needs and align it with your company culture. However, this approach can also be costly and time-consuming. It requires recruiting, training, performance management and retaining HR professionals, as well as investing in HR software and infrastructure.

On the other hand, partnering with an EOR service provides numerous benefits that can make a significant difference in your business. With an EOR, you can leverage their expertise in navigating the complexities of (US) employment law and regulations. This ensures that you remain compliant and avoid legal and financial risks. Additionally, an EOR can offer the flexibility of scaling your global workforce up or down, quickly and efficiently, without the challenges of handling payroll, benefits administration, and tax compliance.

By choosing an EOR, you gain access to comprehensive benefits packages that can attract and retain top talent. Our state-specific knowledge allows us to navigate the intricacies of employment laws in different US states, ensuring compliance and minimizing risks. A partnership with Foothold America means you can focus on your core business activities while we handle the administrative burdens of HR.

Ultimately, the decision between an in-house HR department and an EOR depends on your business’s unique needs and resources. While an in-house HR department may offer more control, an EOR provides expertise, cost savings, and peace of mind whilst navigating the complexities of US employment law with confidence.

Choosing the Right Employer of Record For Your Business

Selecting an Employer of Record that aligns with your business needs is critical for a successful global expansion. Consider the following factors when choosing an EOR partner. Please note that Foothold America has been selected as one of the world’s leading EOR providers by numerous platforms.

👉 Experience and Expertise

Look for an EOR with a proven track record and extensive experience in the countries or regions you are targeting. Ensure they have the necessary expertise in local labor laws, tax regulations, and cultural nuances.

👉 Compliance and Risk Management

An effective EOR should have sound compliance systems in place to ensure accordance to employment laws and regulations. Seek an EOR partner that prioritizes risk mitigation and has a robust compliance framework.

👉 Technology Infrastructure

Evaluate the EOR’s technological capabilities, including payroll software, HR management systems, and reporting tools. A state-of-the-art digital infrastructure can enhance efficiency and streamline communication.

👉Support and Communication

Ensure the EOR provides reliable and accessible support to address any HR or compliance-related queries. Responsive communication channels and a dedicated account management team are valuable assets.

How Much Does an Employer of Record Cost?

The pricing structure for Employer of Record (EOR) services typically varies based on factors such as the number of employees, the complexity of employment agreements, the states involved, and the scope of services required. EOR service providers in the USA may offer pricing options based on a per-employee fee or a percentage of the employee’s salary. Additional services like payroll processing, HR administration, tax compliance, and benefits administration may also be priced separately.

As an example, Foothold America offers highly competitive pricing for the Employer of Record (EOR) services, with several key advantages. Foothold America does not charge any onboarding or offboarding fees, making it easy for companies to smoothly manage workforce reductions or terminations without incurring additional costs. For a fee as low as $650 month, Foothold America provides exceptional value for organizations seeking comprehensive EOR services, enabling companies to have a reliable and professional employer in the United States at an affordable price.

Should your company consider an Employer of Record?

Considering an Employer of Record (EOR) service can offer numerous advantages when it comes to building a distributed workforce and ensuring compliance across jurisdictions. To determine if your organization should work with an EOR, ask yourself the following questions:

- Expansion into new markets: Are you planning to explore new markets or expand your operations internationally?

- Talent acquisition and retention: How do you plan to acquire and retain talent in the different areas where your organization operates?

- Contractor classification: How will you approach the classification of contractors and ensure compliance with local laws?

- International employment law compliance: Do you have in-house resources with expertise in international employment law compliance?

- Administrative processes and employee control: How much control are you willing to give up when it comes to your employees and various administrative processes?

- Multi-country providers: Do you already have other multi-country providers that can handle the compliance challenges associated with an international workforce?

- Market-specific coverage: In which markets do you need coverage and plan to hire employees?

Considering these points can help you evaluate whether an Employer of Record service is the right choice for your organization’s specific needs and growth strategies. It is also recommended to consult with HR and legal professionals to ensure a comprehensive assessment.

Conclusion

Expanding your business into the US market requires careful consideration of employment laws, regulations, and administrative tasks. Employer of Record services, like those offered by Foothold America, provide businesses with a comprehensive solution to simplify the process and mitigate the associated risks. By partnering with an EOR, companies gain access to a wealth of expertise in US employment law, comprehensive benefits packages, and a trusted partner to guide them through the complexities of expanding into the United States. By making an informed decision and selecting the right partner, businesses can unlock the full potential of international growth while ensuring compliance and operational efficiency. Start your US expansion journey on solid ground with the support of Foothold America’s Employer of Record services. Contact us today to start your expansion journey!

How to Hire in the USA with an EOR Service [eBook]

Are you planning to hire in the USA but feeling overwhelmed by the complexities of US employment law and regulations? Look no further! We have the perfect solution to simplify this process for you. Introducing our new ebook: ‘How to Hire in the USA with an EOR Service’.

FAQ’s

Get answers to all your questions and take the first step towards a US business expansion.

An Employer of Record (EOR) does assist with US tax filings as part of its comprehensive employment services. EORs handle payroll administration, including tax withholding, and ensure compliance with local, state, and federal tax laws. By taking on the role of the legal employer, EORs assume responsibility for managing tax obligations and reporting, relieving businesses of this administrative burden.

EORs work closely with clients to calculate and withhold the correct amount of taxes from employees’ salaries, including federal income tax, Social Security tax, and Medicare tax. They also ensure that tax documents, such as W-2 forms, are accurately prepared and submitted to employees and the relevant tax authorities.

The mandatory benefits for US employees vary depending on the specific laws and regulations at the federal and state levels. However, some common mandatory benefits include:

- Social Security: US employers are required to contribute to Social Security, which provides retirement income, disability benefits, and survivor benefits.

- Medicare: Employers are also required to contribute to Medicare, which provides healthcare coverage for individuals aged 65 and older and certain individuals with disabilities.

- Unemployment Insurance: Employers are typically required to provide unemployment insurance, which provides temporary financial assistance to workers who have lost their jobs through no fault of their own.

- Workers’ Compensation: Employers are generally required to provide workers’ compensation insurance, which covers medical expenses and lost wages for employees who are injured or become ill as a result of their work.

It’s important to note that these are just a few examples of mandatory benefits, and the specific requirements may vary by state. Employers should consult with legal professionals and governmental resources to ensure compliance with all applicable laws and regulations.

The employer costs for full-time employees in the USA can vary depending on various factors such as industry, location, and the specific benefits offered. On average, total employer compensation costs for private industry workers in the USA averaged $41.03 per hour worked, according to the Bureau of Labor Statistics (BLS) as of June 2023. This includes wages and salaries as well as benefit costs.

Wages and salaries accounted for approximately 70.6% of employer costs, averaging $28.97 per hour worked. The remaining 29.4% of employer costs, on average $12.06 per hour worked, comprised benefit costs[3].

It’s important to note that these figures are averages, and actual employer costs can vary significantly based on factors such as the size of the company, employee demographics, industry, and the specific benefits offered. Employers should consider consulting with HR professionals or industry resources to get a more accurate estimate of the employer costs for their specific situation.