You are expanding your company to the US, and you know you’ll need people. Often this step comes shortly after you have had some sales in the US. Congratulations on making it this far.

When you develop your game plan for US expansion, having an accurate budget improves your chances of success. This can be surprisingly difficult because service providers will share their fees, but don’t often provide insight into the ancillary costs around their services. This article gives you a comprehensive list of US employment costs so you can confidently tick this box on your overall US expansion budget.

If you’re thinking hiring US workers is going to be more expensive than your home country, chances are you’re right.

In general, US salaries are higher than the UK, most of Europe, Asia and Oceania.

Let’s look at the average salary in USD for SaaS Sales Executives around the world. We gain some insight from the table below, however comparing countries and salary is just the beginning of the story.

Sources: Payscale.com, Reed.com, Reed.co.uk, CNBC.com, Figures.HR, Comparably.com, Wageindicator.org, Flex.capital

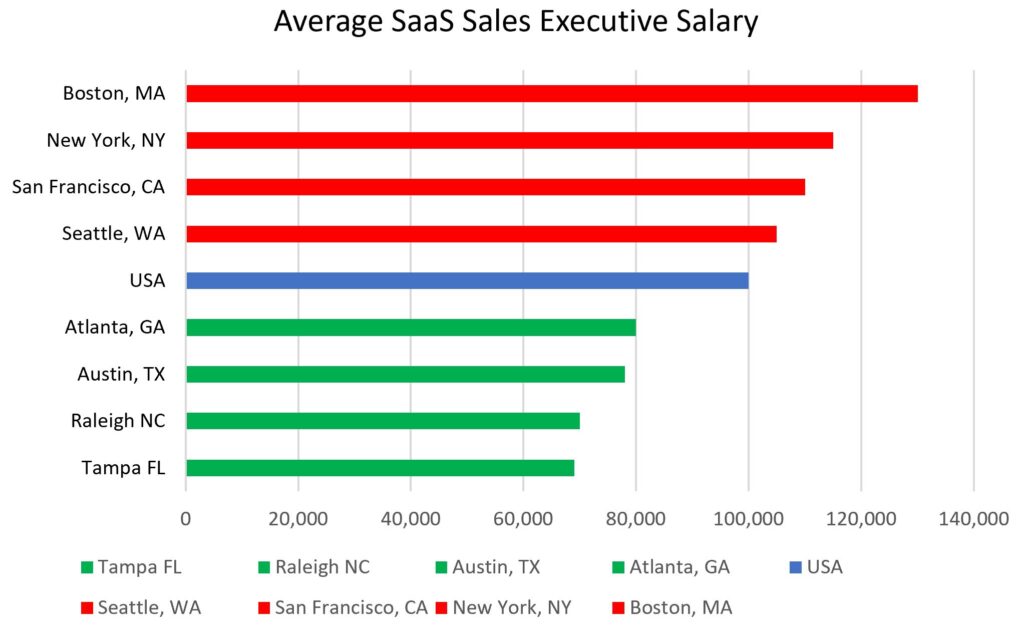

In the US, like many countries, salaries vary dramatically around the country, costing more in major cities. Not only are US salaries higher than many countries, but we’ve highlighted major US cities below to illustrate how the location of your US employee can significantly impact your bottom line.

Sources: Payscale.com, Reed.com, Figures.HR, Wageindicator.org

When you review these and other cities, you’ll see the east and west coasts of the US are the most expensive, whereas employees in the southern US states earn lower salaries.

You may wonder if you can attract the talent you need in low-cost areas. In the case of SaaS sales, candidates often have a business or marketing degree and experience in software sales, which you can find in many metropolitan areas of the US.

Foothold America CEO, Joanne Farquharson, says many of their Employee Management Service clients with their first few US employees, hire for business development or account management roles. “Unless your product requires a degree in a specialized subject matter and there are other compelling reasons to be in a high-cost industry hub, we suggest recruiting employees in lower-cost cities and regions ” says Farquharson.

Not only is the amount of salary important, but you must be familiar with employee classifications and its impact on how you pay wages. The Fair Labor Standards Act (FSLA), instituted in 1938, outlines employee protections for minimum wage, overtime pay, and pay frequency. Employees are categorized as either Exempt or Non-exempt from the statutes of the legislation. Determining the classifications of some positions can be tricky. Even seasoned HR professionals will deliberate over classifications. Typically, executive, administrative, professional, some computer-related positions, and sales positions are exempt from overtime pay. Some states have a minimum wage for exempt employees. In California, to avoid paying hourly and overtime wages to a computer software employee, their salary must be at least $104,150 per year. Make a mistake with this legislation and prepare yourself for severe fines and possibly back pay.

In many parts of the world, employees are paid once per month. FLSA and many state employment regulations require more frequent pay. In general, US employees are paid either every two weeks or twice a month. It’s important to be aware of the cash flow impact of payroll every two weeks. This pay frequency means there are 26 pays per year. Therefore, two months of the year, employees receive three paychecks. It may seem a minor point, but it frequently catches non-US finance departments off guard the first year.

While gross salary is a fundamental piece of information, it is but a small part of the total cost to you, the employer. You’ll be paying taxes to fund the country’s public welfare systems such as social security and unemployment protection. Other costs associated with employment may include workers’ compensation coverage and state-mandated parental leave, for example. In the US, taxes may appear low at first glance, however, the additional cost of private health insurance makes employing US workers as costly as higher tax countries, such as Denmark and France (more about this later).

As a US employer, you are responsible for federal, state and possibly local taxes. Fines for late or non-payment of employer-related taxes are steep and unyielding. The Internal Revenue Service (IRS), the taxing body of the US federal government, assesses a fine of 2% of payroll for a late payment of just one day. Six days or more and the fine rises to 5%. Late payment after 16 days, results in a 10% penalty plus interest climbing to as much as 15% of payroll. In addition, the states where the employees are located also charge significant penalties for late payment of employer withholding taxes.

What are the taxes for which you’ll be responsible? Here is a basic lexicon for US employer taxes.

FUTA (pronounced foo-ta) – Federal Unemployment Tax Act. This tax revenue is charged to employers by the federal government then distributed to states for their unemployment funds. Since 2011, FUTA has been set at 6% of the first $7,000 of employee salary earned, a mere $420 per employee per year.

SUTA (pronounced soo-ta) – State Unemployment Tax Act. Each state controls the amount of SUTA it collects from employers to supplement the funds provided by the federal government. The rates vary and may consider an individual employer’s unemployment rate. In other words, if you terminate a lot of employees, your SUTA rates can go up. In times of high unemployment, employers will see an increase in these rates as the unemployment coffers need to be refilled.

FICA (pronounced fy-ka) Federal Insurance Contributions Act often referred to simply as Social Security, supports US individuals with a few distinct benefits – retirement, survivorship, disability, and supplemental health. Employer withholdings are separated into two buckets – Social Security and Medicare, making up 6.2% and 1.45% of employee salary, respectively. There is a cap on wages subject to Social Security tax, however, there is an additional tax for high wage earners.

Workers’ Compensation insurance is required by all employers and is used to pay wages of workers who become injured on the job. The rates are based on job classification and salary. Further, rates are set by private insurance companies though some states maintain their own funds and rate calculations. The formula below can be confusing for employers who simply want to know what it is going to cost.

As an example, for an inside salesperson making $100,000 per year an employer may pay approximately $350 per year in workers’ compensation coverage. Jobs with a greater chance of injury, such as construction workers, can be 30 or 40 times the cost.

So far that $100,000 salesperson costs you about $110,000 a year. Not bad, right?

If you know enough about the United States to suspect it must cost more than that, you are correct. Here comes the part of the employment conversation that can disillusion the most determined entrepreneur.

Let’s talk about the US health insurance system.

A small portion of US citizens has access to the government health insurance programs, Medicaid and Medicare, that are for the poverty-stricken and elderly, respectively. Since the 1940s, employers were brought into the health insurance business inadvertently due to legislation made necessary by World War II. The Stabilization Act of 1942, limited wage increases to combat inflation during the war. To attract workers, employers began offering health plans as an incentive because contributions toward healthcare premiums were not considered taxable income. As the cost of health insurance increased, so did the impact of the tax incentive.

Today, more than half of Americans obtain health coverage via the private healthcare system made available through employers. There are millions of tax dollars saved by employees and employers each year because of how the system evolved. You can imagine how entrenched this system of healthcare distribution is and why some object to a national health service.

In 2010, with the implementation of the Affordable Care Act (ACA), the federal government imposed a requirement on employers for the first time to contribute to employee health insurance, yet it only applied to those with more than 50 employees. Even without a mandatory health insurance requirement, most US companies offer group health insurance plans. Employers that don’t offer robust health insurance benefits will have difficulty attracting and retaining workers. This is especially true for non-US companies with a limited US presence because workers may not have confidence in a foreign organization’s understanding of US work culture and employee expectations.

For more than 20 years, the Kaiser Family Foundation’s annual employer health benefits survey has provided a benchmark for employers offering employee benefits. Are you ready? In 2021, the average employer contribution toward family coverage was over $16,000 per employee per year, and individual health coverage was nearly $8,000 per employee per year.

When you factor in other benefits such as dental, vision, life, and disability insurance to offer a comprehensive employee benefits package, plan on paying another few thousand dollars per employee per year.

Employee retirement plans, called 401k plans, are not mandatory in the US, but just as with health insurance, wise employers offer this benefit. The average employer contribution toward retirement is between 3% and 6% of salary up to IRS annual limits according to the US Bureau of Labor Statistics. Unlike some other countries, bonus pay in the US is subject to retirement contributions. It’s a detail that’s easily overlooked and can throw your budget into disarray. Imagine that the generous 10% performance bonus you give costs you 14% of employee salary because you have a 4% retirement contribution.

Speaking of bonuses, the average annual bonus in 2021 for exempt employees was 11.6% of salary, while non-exempt employees saw year-end bonuses of 5.6% of salary according to Zippia The Career Experts.

In a tough job market, employers must get creative to attract employees. Benefits such as signing bonuses, paid parental leave, car allowances, and gym memberships are a few that can bloat your payroll by $5,000 to $20,000 per employee.

Lastly, the complexity of federal and state employment compliance means you should have a payroll and benefits administrator. Even large employers outsource these tasks. The cost for a foreign employer utilizing an Employer of Record service to manage employment risks and avoid creating a US entity and an HR department is approximately $9,000 – $12,000 a year per employee.

If you’ve read this far, perhaps the cost of US employment hasn’t deterred you from your US expansion plans. That’s great, because you may find like so many other non-US companies, your US revenue could easily eclipse your home country or worldwide revenue.

Let’s add it all up. The US employee with an annual salary of $100k could cost $135k or more.

There’s some good news too. US employees work a lot. You are not mandated to offer paid time off and offering as few as 15 days of vacation puts you ahead of many US employers. Though the work-life balance in the US has improved over the years, the mentality of a US worker is to take short vacations and respond to emails on weekends and holidays.

Adding up the cost to employ a worker doesn’t give you the true insight you need to make hiring US workers effective for your company. Understanding US work culture and the expectations of employees will ensure you retain employees and that’s key. Turnover costs companies billions each year, or about one-third of an employee’s annual salary per replaced employee according to the Society for Human Resource Management (SHRM). When you plan your US expansion, be sure your trusted partners can guide you in these employment nuances.

As a successful entrepreneur, you’ve likely hired employees in your home country. The taxes and benefits are obvious to you because you know the territory. Some day the US will be the same for you. In the meantime, make your plans armed with the true cost of employing US workers and contact us to speak with a US expansion advisor today.